Some pros and cons of the three JSF competitors.(joint strike fighter; Boeing Co., Lockheed Martin Corp., McDonnell Douglas Corp.)

In June, the three teams led by Boeing, Lockheed Martin and McDonnell Douglas now competing for two Joint Strike Fighter development berths submitted their proposals to the Pentagon for evaluation.

The teams were asked to develop three versions of a common aircraft that would replace Air Force F-16s, Navy and Marine Corps F/A-18s and Marine and Royal Navy Harriers, and be capable of conducting both air-to-air and air-to-ground missions. The JSF would enter service in 2013.

The Air Force version would take off and land on conventional runways, the Navy version would be able to operate from aircraft carriers, and the Marine Corps/Royal Navy version would be able to take off and land vertically. The Air Force versions would carry air-to-air weapons or two 1,000-pound bombs internally, while the Navy version would carry anti-air missiles or two 2,000-pound bombs, also internally.

All of the planes would be stealthy, powered by a single engine--planned to be the Pratt & Whitney F119--and have a supersonic capability. In addition, the planes are supposed to be relatively low cost, between $28 million and $32 million apiece, and be economical to operate. To help control cost, the military stipulated that all three would share at least 80 percent of the same parts and structures.

With those marching orders in hand the companies bent to the task of creating aircraft that would meet all the requirements and have invested tens of millions of dollars on their designs.

Here is an alphabetical look at the three proposals and their pros and cons:

BOEING

JSF History: Boeing originally was to have been teamed with Lockheed Martin as an extension of the F-22 program on which the two are now working. But Boeing was pressing for an entirely new approach to the aircraft, while Lockheed wanted a less risky approach, so no deal was struck and the two became competitors.

Pros: Boeing's design is considered the most advanced of the three with novel design features that could yield the largest life-cycle cost savings--such as a one-piece thermoplastic wing--a key aspect of the program. It also has the greatest commonality between the three versions of the aircraft, thanks in part to the one-piece wing. Some believe the plane is so promising that a Boeing-based JSF would not be dated before it begins its service life in 2013. Proven commercial design and production techniques would be used on the new fighter. One engine would generate both forward and vertical thrust.

Cons: The design could cost more than $1 billion allotted for development to bring to fruition, analysts say. Engine thrust for vertical lift is vented through a complex series of ducts along the underside of the aircraft. In addition, Boeing has not been a prime fighter contractor since 1930s. Also, the plane's appearance--reminiscent of the chunky A-7 Corsair II--is considered by some pilots, who favor sleek aircraft, to be ungainly.

Impact: A JSF victory would return the company to the fighter business after a 60-year hiatus and position it well for the 21st century. A JSF loss would be painful, but not jeopardize the company largely because of its preeminence in the global commercial jetliner market in which it has a 70 percent share, and extensive military programs.

LOCKHEED MARTIN

JSF History: The Lockheed Martin JSF is essentially a single-engine variant of the company's F-22, sharing similar avionics, subsystems and powerplant.

Pros: The Lockheed Martin design is widely regarded as the least risky and potentially the lowest cost approach. The company has vast fighter and advanced aircraft design experience, as well as efficient production facilities. The aircraft would be built at the company's Fort Worth, Texas, plant which now builds the F-16, a factor that would help reduce production costs because the company does not need to facilitize a new plant. One engine would generate both forward and vertical thrust.

Cons: Design characterized by some as "dated," a condition that would only worsen with time, especially by 2013.

Impact: A JSF victory would give Lockheed Martin a lock on the U.S. fighter business, ensuring decades of business on multiple fronts--the F-22, F-16 support and the JSF. A Lockheed Martin win could, however, raise serious industrial base questions, a factor the company is willing to mitigate by allowing a losing contractor to build one of the plane's versions. A JSF loss would be damaging, but the company would survive given its broad product base, F-22 production and F-16 sales and support.

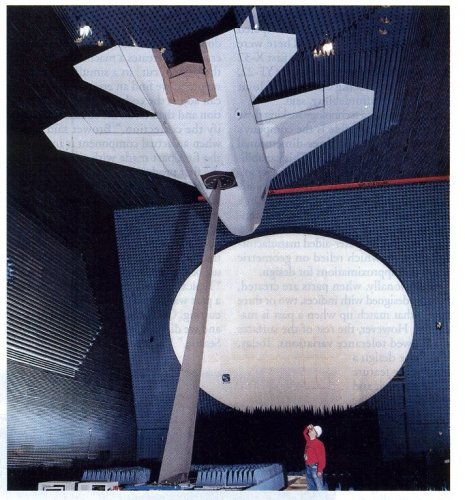

McDONNELL DOUGLAS

JSF History: McDonnell Douglas' design based in part on the company's YF-23 proposal that lost to Lockheed Martin's bid for the Air Force F-22 contract. The MD aircraft was said to have lost because it was more advanced than the F-22 but also was more risky. To bolster its team, MD recruited Northrop Grumman for its stealth and systems integration skills, and British Aerospace, designer of the Harrier and the pioneer in short-takeoff and landing aircraft.

Pros: The McDonnell Douglas design is considered a moderate risk solution with good stealth and low-speed handling characteristics thanks to a near "tail-less" design. Also, open avionics architecture--whereby all systems are designed to a common standard--cuts avionics and systems integration time and costs. Novel bomb-bay allows all versions of the plane to carry either 2,000-pound or 1,000-pound bombs with minor modification. Competing planes can either carry one or the other. Promising YF-23 technologies have been refined over the past several years.

Cons: ASTOVL version has two engines, one in the tail for forward power, another down-ward pointing one for vertical thrust, an arrangement that is said to concern the Marines who fear increased fuel consumption, complexity and maintenance.

Impact: A win would be a major boost for McDonnell Douglas, giving it a valuable and highly profitable franchise for the future as other programs wind down. A loss would have severe long-range repercussions, more so than for Lockheed Martin and Boeing because McDonnell is a prime aircraft contractor with a limited number of major programs, analysts say. But a loss would not put the company into immediate jeopardy because it would continue building F/A-18E/Fs for the Navy and Marines, as well as C-17 transports and T-45 trainers, along with a massive Air Force T-38 upgrade.