You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

US NAVY ATA (Advanced Tactical Aircraft) program: A-12 Avenger II & its rivals

- Thread starter overscan (PaulMM)

- Start date

donnage99

ACCESS: Top Secret

- Joined

- 16 June 2008

- Messages

- 1,355

- Reaction score

- 864

Are you sure that northrop ATA bid has a side by side 2 seater?Orionblamblam said:My take on it, with 80 foot span, 46 foot length, with B-2 for scale.

donnage99 said:Are you sure that northrop ATA bid has a side by side 2 seater?Orionblamblam said:My take on it, with 80 foot span, 46 foot length, with B-2 for scale.

I'm told that "$5 Billion" describes it as such. I don't have a copy of the book, I'm afraid, given that it costs about as much as I'll make *this* *week.*

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

Orionblamblam said:donnage99 said:Are you sure that northrop ATA bid has a side by side 2 seater?Orionblamblam said:My take on it, with 80 foot span, 46 foot length, with B-2 for scale.

I'm told that "$5 Billion" describes it as such. I don't have a copy of the book, I'm afraid, given that it costs about as much as I'll make *this* *week.*

I have a copy of this book from back a few years when they were selling them at a few bucks a pop to clear the stack of boxes at back of the Navy Institute... While almost all of it is an in depth expose of the insanity of Navy contracting at the time (which takes a certain insanity to read it all, though I found the same inbred problems scaringly similar to defence procurement here in Australia) there is a brief look at the differing offers from an aircraft perspective.

There is also a quoted page from the NAVAIR technical review on the A-12A offerings from both GDFW and McAir Team and the Northrop, Grumman and LTV team. Plus the picture I uploaded earlier (which is clearly side by side seating). Anyway from Stevenson's "5 Billion":

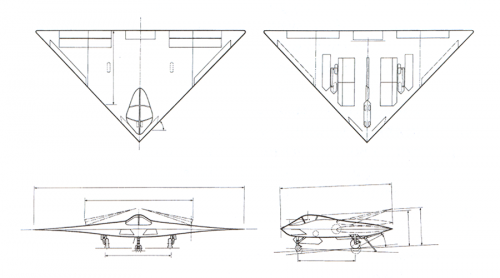

Early Configuration Summary

Area: 1,720 sq ft

Span: 80 feet

Length: 46 feet

Unique features: Tips raise for carrier ops. Side-by side crew

Propulsion: (2) [F404]F5A2 engines

Static thrust: 2 x 14,200 lbs

Inlets: Upper surface setback

Exhaust: Upper surface

Radar: Ku Band, conformal passive in wing L.E.

Takeoff weight: 69,713 lbs

Payload: 5,160 lbs

Fuel: 21,322 lbs

Wing loading: 41 lbs/sq ft

Spotting factor: 1.44

Launch wind over deck (WOD): -2 knots

Arresting WOD (Mk 7 mod 3): +9 knots

Waveoff rate of climb: + 680 feet/minute

"NavAir Technical Review and Assessment of BRR Concept Formulation", 27 March 1987

One hopes there is a nice, juicy chapter on the A-12A in Tommy Thomason's forthcoming study of post war USN attack aircraft. Other than that information on the Northrop A-12A is pretty thin. No doubt because much of the design (the wings at least) has been reused in the X-47B and probably their 2018 Bomber.

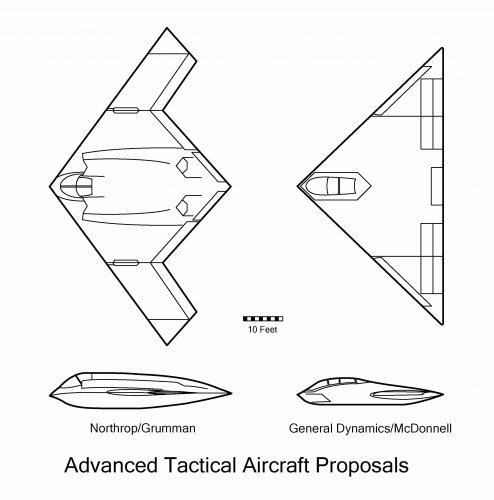

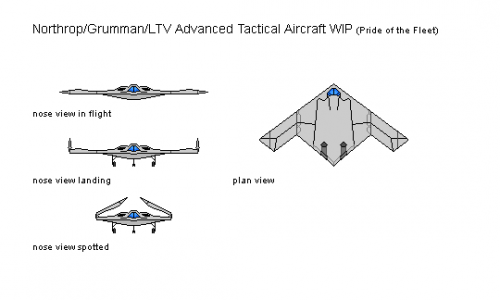

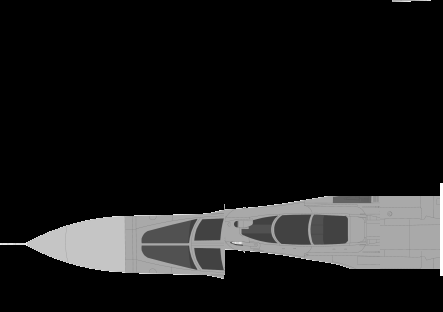

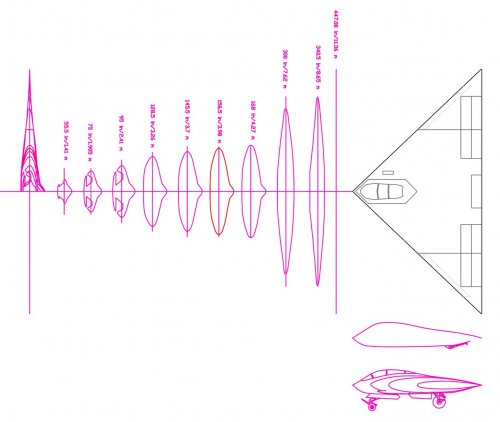

I'm finally getting around to drawing up the A-12. Here's the basic top view to scale with the Northrop ATA, with an additional view showing the two vehicles with their outer wing panels removed (in lieu of showing them folded), superimposed to show deck spotting. The Northrop design would have taken up a bit more space.

The N-ATA canopy configuration is purest guesswork. It more than likely was much larger than shown here.

The N-ATA canopy configuration is purest guesswork. It more than likely was much larger than shown here.

Attachments

My version is also based on the pictures in Stevenson's book, with assistance from Tony Chong and Jens Baganz. I like my canopy but there's no evidence for it. I like Orion's side view although it might be a bit too sleek. Extending the elevons out to the wing tips might be a blunder on my part.

Attachments

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

Great pictures. I think the straight wing fold line in the Tailspin drawing is probably a bit more likely than the angled line on the Orion drawing. The roof canopy is an interesting concept. The ATA flight profile was to include low altitude penetration so it would make some sense from a crew view perspective but not top side LO.

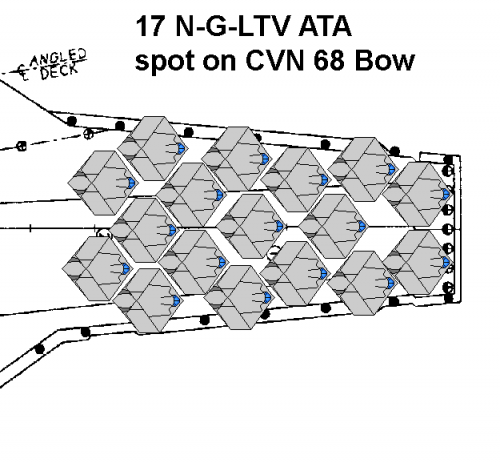

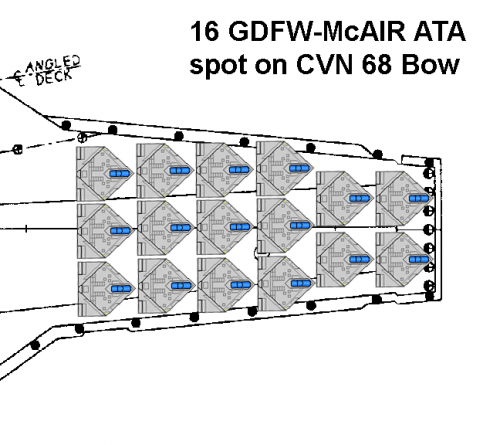

On spotting the Northrop ATA did have a higher spot factor than the General Dynamics ATA. From the same source as the other data it was 1.44 (Northrop) to 1.32 (General Dynamics). This is a factor based on 1.0 being an A-7. Though spot factors are calculated by square meterage and the Northrop ATA folds into a hexagon shape compared to the truncated triangle of the A-12A. This would enable much more efficient use of space in nose to tail parking. The good people at Shipbucket have drawn the various ATAs parked on a Nimitz showing the Northrop design actually can fit more in.

As to other carrier suitability factors the following are very significant:

Launch wind over deck (WOD): -2 knots (Northrop) vs +19 knots (General Dynamics)

Arresting WOD (Mk 7 mod 3): +9 knots (Northrop) vs +12 knots (General Dynamics)

Waveoff rate of climb: + 680 feet/minute (Northrop) vs - 100 feet/minute (General Dynamics)

Negative waveoff climb rate! Even if the A-12A had meet its predicted 40,000 lbs empty weight in the 87 technical review it still would have lacked a waveoff capability! Wrong choice for so many reasons.

On spotting the Northrop ATA did have a higher spot factor than the General Dynamics ATA. From the same source as the other data it was 1.44 (Northrop) to 1.32 (General Dynamics). This is a factor based on 1.0 being an A-7. Though spot factors are calculated by square meterage and the Northrop ATA folds into a hexagon shape compared to the truncated triangle of the A-12A. This would enable much more efficient use of space in nose to tail parking. The good people at Shipbucket have drawn the various ATAs parked on a Nimitz showing the Northrop design actually can fit more in.

As to other carrier suitability factors the following are very significant:

Launch wind over deck (WOD): -2 knots (Northrop) vs +19 knots (General Dynamics)

Arresting WOD (Mk 7 mod 3): +9 knots (Northrop) vs +12 knots (General Dynamics)

Waveoff rate of climb: + 680 feet/minute (Northrop) vs - 100 feet/minute (General Dynamics)

Negative waveoff climb rate! Even if the A-12A had meet its predicted 40,000 lbs empty weight in the 87 technical review it still would have lacked a waveoff capability! Wrong choice for so many reasons.

Abraham Gubler said:Great pictures. I think the straight wing fold line in the Tailspin drawing is probably a bit more likely than the angled line on the Orion drawing.

Very likely. As originally drafted, just "traced" over the top-view photo, the vehicle was too short in length for its span. Looking at the photo more closely, it looks like the picture was taken at fairly close distance, centered right over the tip of the "tail." Perspective would cause parallel lines like the wing folds to point "inwards." Spreading them outwards to make them parallel would also have the effect of moving the inlets outboard and makign the cockpit wider... a good thing considering that it was side-by-side seating.

http://z11.invisionfree.com/shipbucket/index.php?showtopic=1378

A pity you've got to be registered to see whatever's there.

I'll post a corrected version when I can.

Abraham Gubler said:On spotting the Northrop ATA did have a higher spot factor than the General Dynamics ATA. From the same source as the other data it was 1.44 (Northrop) to 1.32 (General Dynamics).

According to AutoCAD, the N-ATA takes up 110.6 sq. meters, the A-12 92.15... a ratio of 1.2:1. Your data of 1.44 to 1.32 works out to a ratio of 1.09:1. When you factor in that the drawings show the outer wings just hacked off, rather than folded (which would make the outlines a bit more complex)), I guess things aren't *too* far off. If the Northrop design does a better job than the GD design of foldign the wings ou of the way, it might work out just right.

Anyway, here's the revised N-ATA. Reworked the fold lines, the cockpit/upper fuselage contour, the underside contour and the canopy frames. I tried to make the canopy roughly the same sort of size as that for the A-6 Intruder, also shown to scale.

Attachments

I suppose it'd be appropriate to throw in the N-381 "Manta" as well...

Last edited by a moderator:

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

donnage99 said:The side-by-side seaters are just way too narrow if compared them to the A-12 cockpit.

There is also a drawing in Stevenson's book of the A-12A in a side-by-side configuration (Model 21). Have to jiggle some cables and scan that in some time today.

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

Orionblamblam said:A pity you've got to be registered to see whatever's there.

OK, forgot that. Been registered for a while as its interesting to see all the 'never built' designs that get drawn fleshing out the many concept studies for warships.

Anyway I've downloaded the pictures in question and attached them here. They show the bow of a Nimitz class carrier loaded nose to tail with the rival ATA designs. Because of the hexagonal shape you can actually fit more Northrop ATAs on the deck than A-12As. At the end of the last two cycles of a flight operations period all the day's flying aircraft (>40) are packed together nose to tail at the bow.

Attachments

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

Orionblamblam said:If the Northrop design does a better job than the GD design of foldign the wings ou of the way, it might work out just right.

Here is a close up of one of the few bits of detail one can see in the picture of the Northrop ATA. It shows a large panel inboard of the wingfold that looks like a cover for the folding mechanism. Considering its size this could enable the wing to fold inwards from a position enabling it to be completely inside the 'chopped off' or hexagonal outer line.

Attachments

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

CFE said:Did the Northrop-Grumman ATA teaming help in any way to grease the skids for the Northrop-Grumman merger?

It wasn't a merger of equals. Northrop brought Grumman for $2.1 billion. They pipped Martin Marietta ($1.9 billion) saving the world from the company name "Martin Grumman"... Though interestingly Grumman approached Northrop first with private talks for the takeover which broke down leading to Martin Marietta being the public merger buyer and then Northrop beat them to the Bethpage Iron Works prize with a higher offer.

NORTHROP BESTS MARTIN MARIETTA TO BUY GRUMMAN

By CALVIN SIMS,

Published: Tuesday, April 5, 1994, New York Times

The Northrop Corporation won the final round today of a heated battle for the Grumman Corporation, the venerable Long Island military contractor. Grumman had decided to seek a merger in the face of its own diminished prospects and declining military spending in the post-cold-war world.

In the monthlong fight for Grumman, Northrop wound up triumphing over the Martin Marietta Corporation by agreeing to pay $62 a share, or a total of $2.1 billion. Northrop's bid exceeded Martin Marietta's by $7 a share, or about $170 million. The Martin Marietta deal would have been worth $55 a share, or $1.93 billion.

Faced with drastic cuts in military spending, weapons contractors have adopted a strategy of acquiring businesses in markets they can dominate and selling off the rest. A deal for Grumman, based in Bethpage, L.I., represented a rare opportunity to acquire a large contractor with a variety of strong weapons programs.

While Grumman has lucrative contracts in military electronics programs, large components for commercial aircraft, and computer information systems and software, the company does not have enough long-term contracts to become a leading force in those areas. Therefore, Grumman officials determined that the company would be better off merging with another contractor than going it alone.

The agreement reached today put an end to the initial plan to merge Grumman with Martin Marietta that was announced publicly on March 7 after Grumman broke off private talks with Northrop.

Under the terms of that agreement, Grumman agreed to pay Martin Marietta $50 million for tearing up the deal and accepting Northrop's richer offer. Martin Marietta said Grumman paid that money today.

Also, Grumman is required to pay up to $8.8 million of Martin Marietta's investment-banking and legal fees and other expenses from the battle.

In the end, Northrop, a weapons maker based in Los Angeles, raised the ante to a level that Martin Marietta believed was too much to pay even for Grumman's highly prized operations in a weapons industry consolidating rapidly amid shrinking Pentagon budgets.

Almost everybody expects layoffs in Grumman's Long Island plants as the merger jells. Grumman acknowledged last month when it announced its plan to link up with Martin Marietta that it would eventually have to eliminate thousands of jobs on Long Island, where 8,900 Grumman workers, or nearly half the total work force of 18,000, are based. With the combination of Grumman and Northrop, industry analysts predicted that 10 to 12 percent of the total work force, which will be more than 40,000 people, would be laid off.

Grumman had agreed on March 7 to merge with Martin Marietta, based in Bethesda, Md., for $55 a share, but was later forced to consider a hostile bid of $60 a share from Northrop, which is best known as the builder of the costly B-2 long range bomber.

Grumman, which had asked both suitors to submit their best offers by 5 P.M. last Thursday, said in a statement today that its board had unanimously approved Northrop's $62-a-share tender offer. Martin Marietta did not increase its offer of $55 a share. Would Not Budge

Phil Giaramita, a Martin Marietta spokesman, said today that the company had determined that $55 a share was what Grumman was worth and that based on its long-term policy, Martin Marietta would not overpay.

"Martin Marietta is a healthy corporation and we have made numerous acquisitions in the past," Mr. Giaramita said. "We are in a position where we can sit back and wait for the right opportunity. Grumman was the right opportunity at $55 a share, but not at $62."

Winning Grumman is a big victory for Northrop, which had failed in two previous attempts to acquire large weapons businesses and was under pressure to make an acquisition or face being swallowed by another military contractor.

Merging with Grumman is also a personal conquest for Kent Kresa, Northrop's chairman, president and chief executive, who was said by friends and associates to be angry that Grumman officials struck a secret merger agreement with Martin Marietta despite a yearlong courtship by Northrop. Mr. Kresa has said that his unrelenting pursuit of Grumman was purely business.

Last edited by a moderator:

donnage99

ACCESS: Top Secret

- Joined

- 16 June 2008

- Messages

- 1,355

- Reaction score

- 864

Does the McDonnell Douglas proposal of the ATA speaks of their less experience in stealth operational effectiveness in comparison to the Northrop bid? The MDD bid is intended to go in at low altitude, so its stealth is masked from AWACS and such, with its under surface setback inlets and exhausts like conventional aircraft method of penetration, while the northrop bid is the opposite. I mean, why do you have to go low and risk visual identification if you going for ultra stealth flying wing?

- Joined

- 18 March 2008

- Messages

- 3,529

- Reaction score

- 977

donnage99 said:Does the McDonnell Douglas proposal of the ATA speaks of their less experience in stealth operational effectiveness in comparison to the Northrop bid? The MDD bid is intended to go in at low altitude, so its stealth is masked from AWACS and such, with its under surface setback inlets and exhausts like conventional aircraft method of penetration, while the northrop bid is the opposite. I mean, why do you have to go low and risk visual identification if you going for ultra stealth flying wing?

Well that is two of the main controversies in the ATA project (there were others!) as outlined in Stevenson's book.

Firstly the level of stealth awareness of the General Dynamics Fort Worth bid (McDonnell Douglas was not the team leader though in some cases their name was placed first. The A-12A was designed by GDFW and was going to be final assembled by them). The Navy had kind of indicated they wanted a stealth builder to team with a naval aircraft builder, like the Hornet project where the light fighter designers (Northrop's F-17 and GDFW's F-16 were teamed with naval builders McDonnell and Vought). Grumman got in with Northrop over Lockheed and GDFW and McDonnell teamed without Lockheed. There were assumptions that because McDonnell was teamed with Northrop on the ATF they would know stealth... Of course the Navy and the succsessful bidders had underestimated what it took (ie cost, weight and schedule) to build a LO aircraft and the A-12A ended in disaster.

On the flight profile the Navy wanted low level penetration but Northrop tried to convince them that LO was better at altitude. The Navy countered by pointing out they had no smart weapons that could be deployed from 40,000 feet (what became JDAM was a USAF program) and curvature of the earth is the ultimate radar countermeasure (of course it wasn't Vietnam anymore and the Soviets were fielding many, many look down shoot down radars). Anyway the Northrop model was turned upside down and its topside RCS measured (not good).

Which indicates that there should be a big RCS model of the Northrop ATA out there or at least some pictures of it (it was probably scrapped). But the continuing life of this design through X-47B and NGB will probably mean it won't be seen until these aircraft are in service.

I think that Scott's last N-ATA drawing is getting pretty close to the real thing, or at least how I've always imagined it based on extrapolating from the early SENIOR ICE concepts. My only question is whether the flaps would have extended to the region aft of the exhausts. I know that engineers generally don't like having moving parts located near the hot flames. But the flaps could serve as a "cheap and dirty" form of thrust vectoring.

Another possibility is that N-ATA had a movable beaver tail like the B-2 does. It could compensate for the loss of flap area if the flaps stopped short of the exhausts (although it would represent lost roll control, assuming the flaps aft of the exhausts were operated differentially.)

Another possibility is that N-ATA had a movable beaver tail like the B-2 does. It could compensate for the loss of flap area if the flaps stopped short of the exhausts (although it would represent lost roll control, assuming the flaps aft of the exhausts were operated differentially.)

After consultations, I've repositioned the cockpit slightly. The underside is anybody's guess, but I still stand by my basic profile of the upper surface including the cockpit. Looking at the photos of the model, it just seems to have the "B-2 Beak" to it, though perhaps not as prounounced.

I suppose along with the N-ATA, the A-12 and the "Manta," the disappointing "Stealthy A-6 Intruder" would also fit in here. That one would of course be just a whole lot of speculation.

I suppose along with the N-ATA, the A-12 and the "Manta," the disappointing "Stealthy A-6 Intruder" would also fit in here. That one would of course be just a whole lot of speculation.

Attachments

donnage99

ACCESS: Top Secret

- Joined

- 16 June 2008

- Messages

- 1,355

- Reaction score

- 864

I thought that McDonnell/GD also signed a contract with Lockheed to help them with stealth, like work on the leading edge and stuff. I read it from that website that is no longer active. Forgot its name, anyone remember?Abraham Gubler said:Grumman got in with Northrop over Lockheed and GDFW and McDonnell teamed without Lockheed. There were assumptions that because McDonnell was teamed with Northrop on the ATF they would know stealth... Of course the Navy and the succsessful bidders had underestimated what it took (ie cost, weight and schedule) to build a LO aircraft and the A-12A ended in disaster.

- Joined

- 1 April 2006

- Messages

- 11,378

- Reaction score

- 10,221

It was Invisible Defenders site, shut down after boss have talked to site owner - due to nature of site owner's job.

Man that GD wanted to make exhaust area for A-12, was Ben Rich.

Man that GD wanted to make exhaust area for A-12, was Ben Rich.

Last edited by a moderator:

donnage99

ACCESS: Top Secret

- Joined

- 16 June 2008

- Messages

- 1,355

- Reaction score

- 864

Thanks, Flateric!

As for the cockpit, I still find it too narrow compared to the A-12 avenger II cockpit. If it's that wide for one person to fit into the A-12, it should be 1.7 times that for two person sitting side-by-side. Take a look at the su-27 and Fullback:

As for the cockpit, I still find it too narrow compared to the A-12 avenger II cockpit. If it's that wide for one person to fit into the A-12, it should be 1.7 times that for two person sitting side-by-side. Take a look at the su-27 and Fullback:

Attachments

donnage99 said:Thanks, Flateric!

As for the cockpit, I still find it too narrow compared to the A-12 avenger II cockpit.

However, it compares well to the A-6 Intruder.

Attachments

donnage99

ACCESS: Top Secret

- Joined

- 16 June 2008

- Messages

- 1,355

- Reaction score

- 864

Forgot to take into account the possibility that a-12 cockpit is wider than typical ones.Orionblamblam said:However, it compares well to the A-6 Intruder.

The A-12 canopy was relatively low and flat, meaning it had to be fairly wide.

The latest zoo of Navy stealth, with the in-progress "stealthy A-6" at left and the Northrop AX at center bottom (with the slim data I have, it appears to be scaled about right... it was, apparently, fairly small). The A-12 is the design I have the most info on, and it's the one taking the longest.

Attachments

flateric said:I want to buy these A-12 drawings that Scott have made from giant original blueprints...

Around about a year ago I had the notion of creating detailed scale drawings as some sort of stand-alone product. As with a lot of my ideas, that one just sort of fluttered away due to being busy and scatterbrained. The A-12 was to be one of those drawing sets. Might still happen in some form, I suppose.

If you want to talk about the "zoo of Navy stealth," it's interesting to look at the progression from ATA to NATF to A-X and A/F-X, to F-117N & A/F-117X and finally to the F-35C. The road to a naval stealth aircraft has been an arduous one, and the final result is somewhat disappointing in my view.

donnage99 said:The Northrop A-X is certainly very small to carry a weapon load similar to the A-6....or does it?

It has more lifting area than the A-6, so perhaps more payload capacity. How much of it would have been internal, and how much external, I can't say. A stealthy plane with a bunch of bombs hanging underneath might be a bit of a contradiction; but if it flies low, the only radar to see it would only see the upper surface.

flateric said:

It would be an expansion of the drawing below. Top, bottom, side, front, rear views as detailed as I can get 'em, along with the sections and inboard profiles (and inboard plan view) showing important inner structures. Conveniently, it would fit nicely on 11X17 paper at 1/48 scale.

Before that, though, it's looking like a US Navy Stealth article for APR is in order.

Attachments

Before that, though, it's looking like a US Navy Stealth article for APR is in order.

Most definitely!

Regards,

Greg

- Joined

- 27 December 2005

- Messages

- 17,749

- Reaction score

- 26,393

Last edited:

Anything further on good quality A-12 drawings and the potential US Navy Stealth article for APR?

Regards,

Greg

Regards,

Greg

The A-12 saga continues:

Please note that this post wasn't meant to raise political issues re the cancellation of the A-12. It is simply to convey news that the A-12 cancellation issue is still kicking along.

Regards,

Greg

General Dynamics to Appeal A-12 Decision

(Source: General Dynamics; issued November 24, 2009)

FALLS CHURCH, Va. --- The U.S. Court of Appeals for the Federal Circuit today denied a request for a rehearing of the Federal Circuit's prior decision sustaining the government's default termination of the A-12 aircraft contract to which General Dynamics and The Boeing Company were parties with the Navy.

General Dynamics disagrees with this most recent decision and continues to believe that the government's default termination was not justified. The company also believes that the ruling provides significant grounds for appeal, and intends to petition the U.S. Supreme Court for review.

General Dynamics, headquartered in Falls Church, Virginia, employs approximately 92,300 people worldwide. The company is a market leader in business aviation; land and expeditionary combat systems, armaments and munitions; shipbuilding and marine systems; and information systems and technologies. (ends)

Boeing Statement on Appeals Court Refusal to Rehear A-12 Case

(Source: Boeing Co.; issued Nov. 24, 2009)

CHICAGO --- J. Michael Luttig, Boeing executive vice president and general counsel, today said that the company intends to appeal to the Supreme Court after the U.S. Court of Appeals for the Federal Circuit refused to rehear the company’s appeal in the long-running A-12 case.

"We are disappointed in today's decision. The Court of Appeals' decision is clearly wrong as a matter of law and it has broad implications for all forms of government contracting nationwide. As a consequence, I have directed that an immediate appeal be taken to the Supreme Court of the United States," Luttig said.

At issue in this litigation, which has been pending over a decade, is the manner in which the Defense Department terminated the A-12 military aircraft program and whether the government owed Boeing (then McDonnell Douglas) and General Dynamics Corporation money for work in progress when the contract was terminated, as well as certain other expenses.

The trial court originally ruled in favor of the contractors, but various appeals over the years have delayed a final decision.

The A-12 was to have been the Navy's next-generation, carrier-based advanced tactical aircraft utilizing low observable "stealth" technology.

-ends-

Please note that this post wasn't meant to raise political issues re the cancellation of the A-12. It is simply to convey news that the A-12 cancellation issue is still kicking along.

Regards,

Greg

Thanks for that - Here's the status as of last June:

thanlont.blogspot.com

thanlont.blogspot.com

A-12: The Gift That Keeps on Giving

A gift to lawyers, in this case. I was surprised when writing the chapter on the A-12 Avenger II program in Strike from the Sea to discover...

- Joined

- 1 April 2006

- Messages

- 11,378

- Reaction score

- 10,221

remains of A-12 'iron bird' in St.Louis Boeing plant

"An unused legacy of the past. Bruce McIlroy, Test and Evaluations Operations manager in St. Louis, is pictured with the A-12 “iron bird,” a

massive fixture used to test the hydraulics of the cancelled U.S. Navy aircraft and now no longer needed."

From Boeing Frontiers, July 2007 issue

"An unused legacy of the past. Bruce McIlroy, Test and Evaluations Operations manager in St. Louis, is pictured with the A-12 “iron bird,” a

massive fixture used to test the hydraulics of the cancelled U.S. Navy aircraft and now no longer needed."

From Boeing Frontiers, July 2007 issue

Attachments

Similar threads

-

Advanced Tactical Support Aircraft (ATSA) US Navy

- Started by dauby09

- Replies: 22

-

Northrop Grumman Supersonic Tailless Air Vehicle (STAV) concept

- Started by flateric

- Replies: 17

-

Convair / General Dynamics Advanced Tactical Fighter (1965)

- Started by overscan (PaulMM)

- Replies: 15

-

VSX / TS-160: Alternatives to the S-3 Viking

- Started by Pioneer

- Replies: 95

-

ADF to LWF: Evolution of the General Dynamics F-16

- Started by overscan (PaulMM)

- Replies: 136