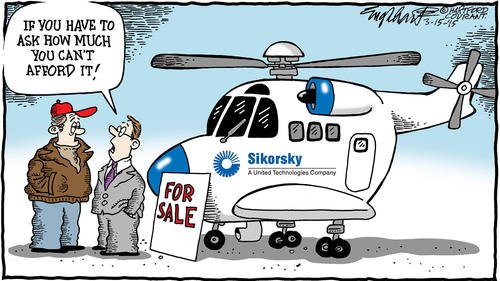

Looks like Sikorsky will divest the Schweizer Aircraft product lines.

"Sikorsky considers shuttering, selling light helicopter lines"

By: Dan Parsons

Orlando

Source: Flightglobal.com

http://www.flightglobal.com/news/articles/sikorsky-considers-shuttering-selling-light-helicopter-409816/

"Sikorsky considers shuttering, selling light helicopter lines"

By: Dan Parsons

Orlando

Source: Flightglobal.com

http://www.flightglobal.com/news/articles/sikorsky-considers-shuttering-selling-light-helicopter-409816/

Sikorsky has canceled production of the S434 light single helicopter and divesting two other light helicopter production lines is under consideration, company officials say.

The S434, S300 piston-powered single and turbine engine S333 production lines were acquired when Sikorsky acquired Schweizer Aircraft in 2004. Partly because of low orders, absorbing the company has been costly for the rotorcraft giant, says Dan Hunter, director of commercial programmes.

“We had a lot of cleanup to do to make that product line be what we wanted it to be as part of the Sikorsky family, either to retain it within the Sikorsky family or to make a good, solid offer to someone who might want to be in that business,” Hunter says on 4 March at the HAI Heli-Expo

asset image

Sikorsky

The S434 production line is officially closed after the Saudi Ministry of Defense bought and then returned several of the four-bladed turboshaft helicopters because they were wearing out before the end of their estimated service lives, Hunter says.

Sikorsky bought Schweizer outright in 2004, then liquidated the company and wholly absorbed its product line in 2012. Despite the cost incurred during the transition, and the S300 product line's uncertain future, Hunter says the acquisition was a sound business decision and Sikorsky continues to deliver aircraft.

Sikorksy will not take new orders for either the S300 or S333, though it has commitments to deliver both to several customers, Hunter says. Sikorsky has already outsourced final assembly to Summit Aviation, which was a longtime S300 supplier, he says.

Selling the S300 production lines outright is being considered, along with the possibility of restructuring the programmes within Sikorsky, Hunter says.

“We have not made a decision on either of those two variants right now," he adds. "We think there is probably a place somewhere where that would be a viable product line. It will be a little while before we decide where that lands and lives.”

The Royal Saudi Ground Forces have bought 11 S333s, which are still being delivered. Sikorsky does have outstanding contracts for the S300 and continues to deliver the 19 aircraft on contract.

Still, the company has commitments for aftermarket service for the 2,800 light rotorcraft in its installed base, Hunter says. Post-production services and maintenance on light helicopters netted Sikorsky $10 million in 2014, “a decent business for us”, Hunter says.

“We are trying to get right so we can make a decision about what is next for that product line,” he says.”