Sikorsky Moves X2 Technology Up A Size For JMR

By Graham Warwick

Source: Aviation Week & Space Technology

November 04, 2013

Scale is everything in rotorcraft: What works at one size might not at another, because of complex interactions between aerodynamics, propulsion, structures and control. That is why the U.S. Army plans to fly competing high-speed rotorcraft demonstrators before deciding which direction to take in replacing its utility and attack helicopters beginning in the mid-2030s.

There are four options for the Army's planned Joint Multi-Role (JMR) technology demonstrators. Bell Helicopter and Karem Aircraft each offer tiltrotors. AVX Aircraft offers a coaxial-rotor compound helicopter, as does a Sikorsky/Boeing team. Following completion of preliminary design, a downselect to two aircraft is planned for July 2014, leading to first flights at the end of fiscal 2017.

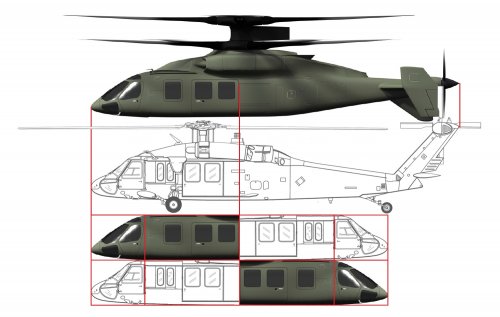

For Sikorsky, the challenge is to prove its coaxial rigid-rotor technology can be scaled up from the 8,000-lb. X2 Technology demonstrator that exceeded 250 kt. in 2010, through the 11,400-lb. S-97 Raider light tactical helicopter prototypes now being built to fly in 2014, to the 230-kt. Sikorsky/Boeing SB-1 Defiant JMR demonstrator—precursor to the Army's planned 30,000-lb.-class Future Vertical Lift (FVL) medium utility rotorcraft to replace Sikorsky's UH-60 Black Hawk.

“Our key goal is to show the technology is scalable,” says Samir Mehta, president of Sikorsky Military Systems. “X2 proved the basic physics and design, Raider is the next weight class up and JMR the next after that. With each increase in size, questions come with the technology. We want to leave no doubt, so will build our JMR demonstrator to full size.”

AVX plans to fly its coaxial-rotor/ducted-fan design at 75% scale, while Bell's V-280 tiltrotor demonstrator would be “92%-plus” scale, says CEO John Garrison. Abe Karem, designer of the Predator unmanned aircraft, is tight-lipped about his TR36TD variable-speed tiltrotor, but says he is “not known for building things subscale.”

Winning one of the JMR air-vehicle demonstrator contracts would vindicate Sikorsky's decision to make speed one of three pillars of its research and development strategy—the others being autonomy and intelligence—and focus on the coaxial rigid-rotor configuration first tested in the 1970s with the XH-59 Advancing Blade Concept (ABC) experimental helicopter and re-invented as the X2 by integrating the latest available technology.

Conventional helicopters are not fast because, with the rotor flying edgewise, as forward speed rises, the airflow velocity increases over the advancing blade until the tip goes supersonic and decreases over the retreating blade until it stalls. ABC overcame this by generating lift on the advancing sides of contra-rotating coaxial rotors, which were slowed to delay shockwave formation at the tips, and off-loading the retreating sides to delay blade stall. The rotors were stiff so they could be close together to reduce drag.

The XH-59 ultimately achieved 263 kt., but required two pilots, four engines and was thirsty, noisy and shaky. Three decades later, the X2 Technology demonstrator exceeded 250 kt. in level flight, and 260 kt. in a shallow dive, with one pilot, one engine and vibration levels similar to a Black Hawk at 150 kt. Fly-by-wire flight control, integrated propulsion, active vibration control and composite materials were among the technology advances that overcame the shortcomings of the XH-59.

The X2 was Sikorsky's response to criticism that neither the U.S. military nor industry was investing in new rotorcraft technology, and instead still building and buying 1970s designs. “The industry was being slammed hard for not being innovative,” says Mark Miller, vice president of research and engineering. “[Former Sikorsky President] Steve Finger ordered an extensive study of technologies that had been tried in the past. As technology advances, things that were not possible back then become worth taking a look at. The X2 coaxial rigid rotor came out of that.”

After designing and flying the X2 demonstrator in 43 months for $50 million in company funds, Sikorsky launched the S-97 Raider program, investing $200 million of its own and suppliers' money in two prototypes to reduce risk in pursuit of the Army's Armed Aerial Scout (AAS) requirement. The Raider also takes the X2 configuration a step closer in scale to JMR/FVL. “The S-97 will provide another data point on the same slope as the X2, but at a different gross weight, and show it can be done quickly and affordably, to an advanced manufacturing readiness level,” says Chris Van Buiten, vice president of technology and innovation and head of R&D arm Sikorsky Innovations.

Launched in October 2010, the Raider program has entered the final-assembly phase. The first all-composite fuselage was delivered by Aurora Flight Sciences in September and has cleared its 115% proof-load test. The landing gear has passed drop and retract tests and is being attached to the airframe. The windshield has successfully completed a birdstrike test at 229 kt., says Van Buiten.

The Raider is scheduled to fly at the end of 2014 and, after a year of envelope-expansion flight tests, Sikorsky hopes to begin demonstrations to the Army at the end of 2015 and be ready for an AAS competition—if the program is delayed, but not terminated, because of budget cuts—in 2016.

In addition to a doubling of mission speed and endurance and 150% increase in high/hot hover performance over the Army's Bell OH-58D Kiowa Warrior, Sikorsky wants to demonstrate specific attributes of the X2 configuration. These include level-attitude acceleration and deceleration using the variable-pitch pusher propeller, 3g maneuver capability and the ability to “hang on the prop” to direct weapons against ground targets.

Along with proving the coaxial rigid-rotor dynamic system scales up, Sikorsky plans to use its JMR demonstrator to show the advantages of those same attributes in the utility role, and particularly the benefits of maneuverability and level-attitude acceleration/deceleration to inserting or extracting troops rapidly and survivably, says Doug Shidler, JMR program director.

Sikorsky's strategy to focus its internal R&D on the three pillars and seek contract R&D to fill any gaps is paying off, says Miller. “JMR is a contract and an investment, and we have been able to attract a partner in Boeing, which is a 'Good Housekeeping' stamp of approval [for the X2 technology],” he notes. “There was nothing new going on, no investment in R&D, and [then-Sikorsky President] Jeff Pino said we can change that,” says Van Buiten. “We moved out with small investments in the three pillars and now we are seeing substantive progress—the X2 has flown, the S-97 is coming and we have won a JMR contract.”

JMR will also be a test of Sikorsky's ability, now with Boeing, to scale up its capacity to design and build an aircraft quickly and affordably. Having invested $250 million of its own and supplier money in the X2 demonstrator and Raider prototypes—without having yet attracted a customer—it faces the prospect of spending more money on the JMR demonstration.

This program requires significant industry investment. It is starting off as a cost-share, with the government leveraging the industry's investment,” explains Mehta. The Sikorsky/Boeing team is not saying what its contribution would be, but the Army has $217 million to spend on two flight demonstrators, and Bell's Garrison says: “The investment by industry is significantly higher than by the government in this program.”

Already 95 Boeing and Sikorsky engineers are working on the Defiant, and the government will get much more that it is paying for with its $6 million preliminary design contract, Shidler notes.

“We've completed an internal conceptual design review and identified strong progress on key technologies to enable the aircraft,” says Mehta. “[JMR] requirements are pretty significant and stretch the boundaries in the dynamics and fuselage, which are strengths of both companies,” he says, citing a transmission design breakthrough “we would not have gotten on our own.”

Lessons learned working together on the canceled RAH-66 Comanche are proving valuable, with Boeing and Sikorsky taking a different approach to sharing the work. “Comanche was component-based, and there was one Boeing and one Sikorsky person on each job,” says Shidler. “[On JMR] we do not take the aircraft and divide it up,” says Mehta. “Technologies are divided into categories and there is a lead for each, but the teams are populated with folks from both companies.”

The companies have teamed in perpetuity on JMR/FVL, which is to replace Boeing's AH-64 Apache as well as the Black Hawk, and a fundamental requirement is to “work together on technology while at the same time retaining our technical competencies. If we take the aircraft and divide it up so that Sikorsky has 100 percent of the dynamics, what happens to Boeing? Or Boeing has 100 percent of the fuselage; what happens to Sikorsky? We both want to advance our competency, attract talent and have our best people working on this program,” Mehta explains.

Cost will be an important factor for FVL, as it already is for AAS. Responding to Army concerns about the cost of the high-speed Raider, Sikorsky took the unprecedented step of publicly committing to a $15 million unit flyaway cost, the upper limit of the Army's procurement budget for AAS. This has been validated, Miller says, with a detailed cost breakdown based on actual parts for the S-97 prototypes or similar parts for other Sikorsky helicopters. “We know what it will cost. We're happy with the numbers,” he says. “This is an assembly of parts that are well known and in production,” adds Van Buiten. “It is an integration of familiar-looking stuff in a different way.”