More news from corporate earnings releases

Classified work fuels Northrop Grumman's growth. In fact, so-called

"restricted" contracts accounted for more than a quarter of the company' 2019 sales, CEO Kathy Warden said during a

Thursday morning quarterly earnings call with Wall Street analysts. The company was awarded classified contracts totaling "nearly $11 billion." Of that, "approximately $7 billion" is for space projects. "We clearly still see space as being a growth driver for us into the future," Warden said.

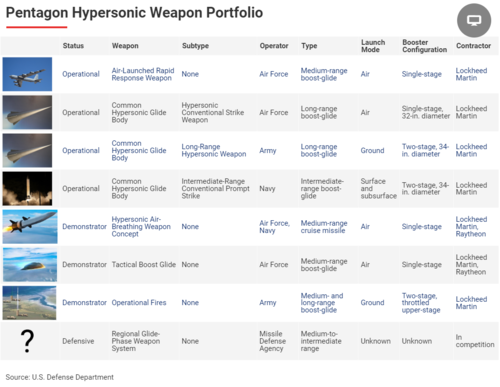

What about hypersonic weapons? Northrop sees itself providing propulsion for hypersonic weapon prime contractors Lockheed Martin and Raytheon. It has relationships with both, Warden noted. But it could also be a system integrator as well. "We do see ourselves following both paths," Warden said. "We want to be a good provider to the primes in propulsion and that means making investments that support multiple technology paths, but at the same time we do have a capability ourselves to prime efforts and be an integrator for certain types of systems."

Northrop sees its space sensors playing counter-hypersonic missions."There [in counter-hypersonics] we see really our expertise in space and the capabilities that we have in space being a key enabler to the future counter hypersonic mission set," Warden said. "We have looked at the space business that we are assembling and view ourselves as both a capable prime and payload provider in that space." This week, DARPA announced a

$13 million contract to Northrop for initial research in the field.

Raytheon sees itself playing a big role in counter-hypersonics. "We view the counter-hypersonic market as more opportunistic for us compared to hypersonics," CFO Toby O'Brien said in an interview Thursday. He pointed to the company's missile defense radars and command-and-control systems that are vital in detecting and tracking missiles. That data is passed on to the interceptor itself. He also noted that while Raytheon doesn't build satellites, it builds sensing technology on satellites. "We're playing in the counter-hypersonic area in different ways, albeit, some classified and not necessarily yet multibillion-dollar type of awards," O'Brien said. "But like hypersonics, opportunity lies in front of us there and we feel good about how we're positioned."

Lockheed is still waiting for counter-hypersonic contracts. "We really were investing in the counter hypersonics, but we really haven't seen any orders there yet," Lockheed Martin CFO Ken Possenriede said Tuesday during the company's quarterly earnings call. "[It] would not surprise us if we're put under contract this year and going forward for counter and those will be dilutive to margins as well."