- Joined

- 16 April 2008

- Messages

- 9,569

- Reaction score

- 14,364

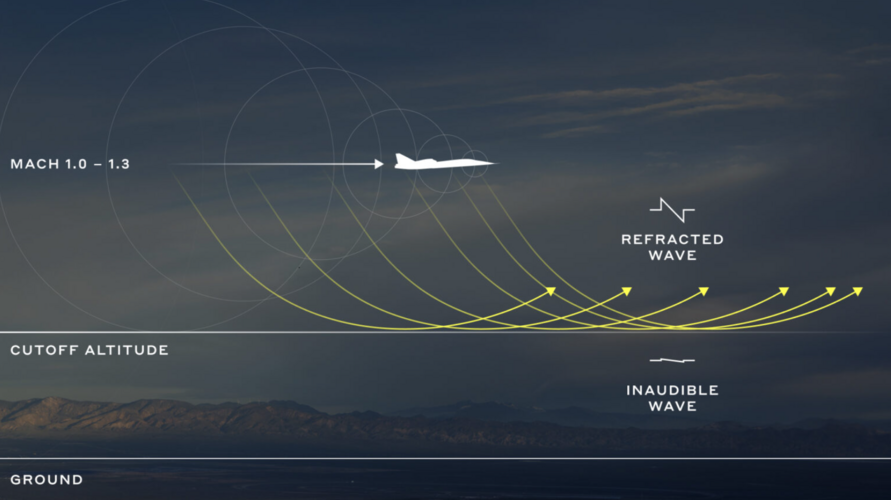

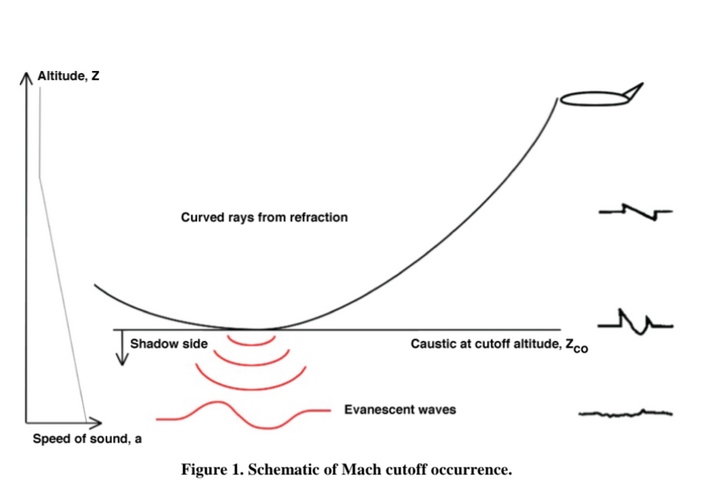

Then, when the FAA finally comes up with a specification for maximum footprint noise level and profile (not just sheer overpressure or decibels, but whether one large boom or multiple smaller booms etc), Boom will have confidence that what their computer models say will happen actually will happen on the full scale prototype.

Boom isn't trying for quiet supersonic. Their plan is to fly subsonic (at Stage 4 noise levels, IIRC) until they get over water, then crank it. Which is why they can't make it as a bizjet, because bizjets aren't often used exclusively for overwater routes.