You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Boeing Middle of the Market (MOM)/New Medium Airplane (NMA) Saga

- Joined

- 6 September 2006

- Messages

- 4,808

- Reaction score

- 9,315

Addison Schonland, chief executive of AirInsight Research feels that the NMA could be a revived 787-3. Perhaps unlikely but it would take care of the upper end of the segment and open the way for a narrowbody 737 replacement.

https://www.flightglobal.com/airfra...7-3-could-be-reborn-as-the-nma/136589.article

https://www.flightglobal.com/airfra...7-3-could-be-reborn-as-the-nma/136589.article

- Joined

- 11 February 2007

- Messages

- 2,490

- Reaction score

- 4,145

"The short-haul 787-3 "Addison Schonland, chief executive of AirInsight Research feels that the NMA could be a revived 787-3. Perhaps unlikely but it would take care of the upper end of the segment and open the way for a narrowbody 737 replacement.

https://www.flightglobal.com/airfra...7-3-could-be-reborn-as-the-nma/136589.article

There's the rub. There's a lot of enthusiasm for long range in the middle of the market right now, look at how the A321LR/LRX have been carving up the market because of their ever longer range capability. It's not impossible to go after the top end of the MoM segment with a twin-aisle, that's what Airbus have done with the A330 Neo, and the 787-3 would carry slightly more passengers, but the problem is range, the 787-3 has a max range of 3050nm. You could probably boost that to 3500nm with extra tankage and increased max weight, but the A330-900 has a range of 7200nm, and the A330-800 has a range of 8,150nm. No matter how much tankage you squeeze in, you won't double the range of the 787-3.

Last edited:

- Joined

- 11 February 2007

- Messages

- 2,490

- Reaction score

- 4,145

Would Boeing now be better served by doing what they should have done with the MAX, retain the 737 fuselage for now, and concentrate their design efforts on new wings, tail, and corresponding undercarriage ?

That's basically a completely new aircraft anyway. New wings would mean new wingbox, and at that point the fuselage is little more than the tube that connects the other bits, particularly as bringing 737 aero-efficiency up to scratch probably requires a nose job.

On top of which the PR optics will be against anything that can be perceived as another warmed-over 737.

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

Why Boeing must end NMA indecision

Critics joke that Boeing's New Mid-market Airplane (NMA) launch is taking almost as long as NASA did to get Apollo 11 off the pad, following JFK's famous man-on-the-Moon declaration.

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

Boeing Hints At New Direction For NMA Refocus | Aviation Week Network

Boeing appears to be redirecting its next new airliner project to compete more directly with the long-range Airbus A321XLR rather than take on the broader 757-767 replacement market previously studied under the shelved New Midmarket Airplane project.

- Joined

- 11 February 2007

- Messages

- 2,490

- Reaction score

- 4,145

Boeing Hints At New Direction For NMA Refocus | Aviation Week Network

Boeing appears to be redirecting its next new airliner project to compete more directly with the long-range Airbus A321XLR rather than take on the broader 757-767 replacement market previously studied under the shelved New Midmarket Airplane project.aviationweek.com

Called it!

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

- Joined

- 25 January 2020

- Messages

- 1,279

- Reaction score

- 1,945

Any new developments regarding this type?

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

Nope. Boeing management are still pretty much focused on trying to rehabilitate the 737MAX.

- Joined

- 25 January 2020

- Messages

- 1,279

- Reaction score

- 1,945

I do wonder whether Boeing is planning a replacement for the 737MAX. Airbus has already revealed some time ago that they were already drawing up a replacement for the A320neo.

- Joined

- 4 July 2010

- Messages

- 2,502

- Reaction score

- 3,051

There's definitely a lot of smoke around about NMA lately, specifically the "NMA-5X" 757-sized aircraft. It's beginning to look like they're preparing a launch.

Analysis of their approach from various aviation pubs seems all over the map, from "NMA-5X is the perfect jet for the post-pandemic" to "-5X is a niche aircraft and Boeing will die if it doesn't focus on replacing MAX with a competitive aircraft." For myself, I still have relatively little faith Chicago Boeing will let Seattle Boeing do the job right.

Analysis of their approach from various aviation pubs seems all over the map, from "NMA-5X is the perfect jet for the post-pandemic" to "-5X is a niche aircraft and Boeing will die if it doesn't focus on replacing MAX with a competitive aircraft." For myself, I still have relatively little faith Chicago Boeing will let Seattle Boeing do the job right.

masimaes

ACCESS: Restricted

- Joined

- 18 January 2022

- Messages

- 35

- Reaction score

- 19

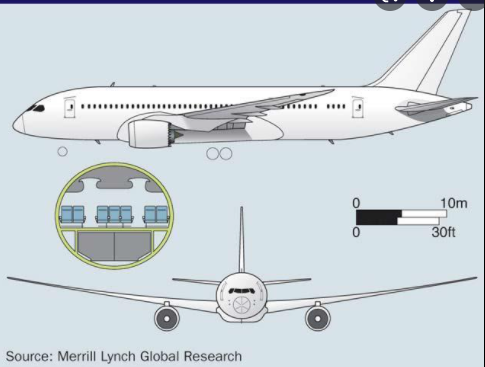

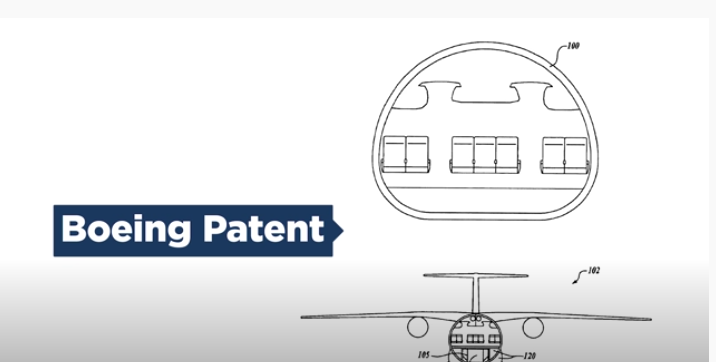

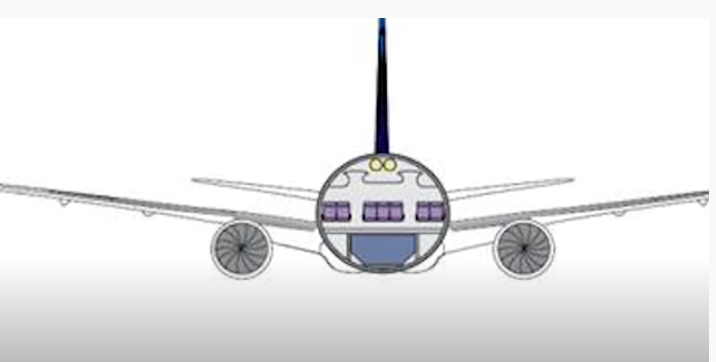

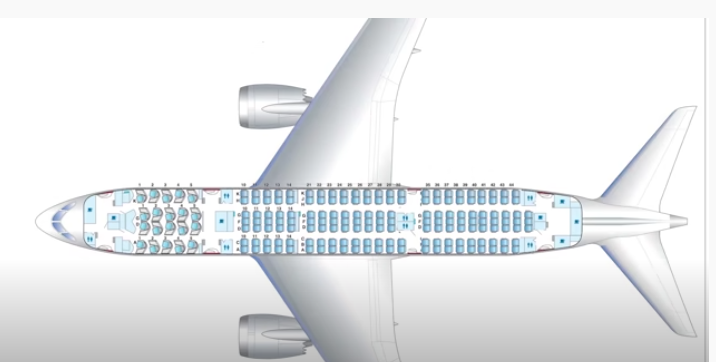

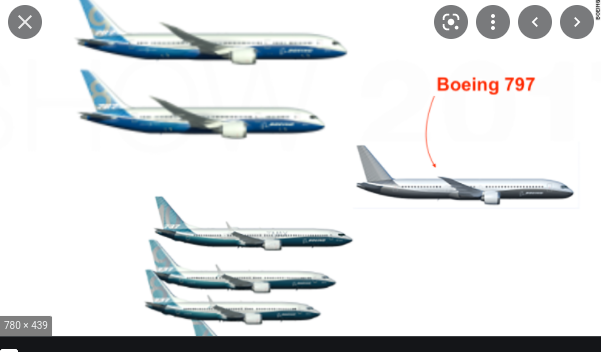

This plane was meant to be boeing's attempt to fix middle of the market aircraft problem and to end the lifespan of the 737 series. The sweet spot which no plane besides the 757 can fly. today we explore the history of the fat 7m7. this was destined to be the shortest widebody of the time.The middle of the market is an airline reqiurement, it requires a 5000 nautical mile range and close to 270 passengers. but the only type of aircraft that fit that spot is the 757, and later, of course, the a321xlr, either the plane is small, like the 737 or to big like the 787. However, in 2015, a small up and start company called aerolinch, sent boeing a proposal for its middle of the market problem. They can't strecht the 737 anymore cause of tailstrikes, so... why not make the plane wider? why not make the 737 fatter, thus the 7m7 concept was born. The 7m7 would feature a eliepictal cabin, which means that it was an oval shape, this would give the aircraft more floor space onboard and it enough to fit 260-270 passengers. to do this, the designers moved the seats of a typical 737 3 by 3 layout and turned it to a very unique 2 by 3 by 2 layout. there would be a throne seat in the middle of the row, and in business class, boeing could deploy a 1-1-1 class . the widebody design made it perfect for short turn- around routes like sydney to chicago. With a wider body, it would also have a wider fuel tank, with more fuel for the standard 737 engines for a range 5,000 nautical miles. this is much further than the range of the 737, which tops out at 3,850 nautical miles. to maintain aerodynamics, the plane would have a tadpole shape when looked at from above, and a tadpole tail. this would give it the space of a widebody plane but the economics of a narrowbody. it would be made of the same materials of the 737. of course, it all comes down to money. boeing would be set to make a saving when it came to manufacturing and engineering this plane. it could use everything the 737 has, saving boeing a fortune. lastly, pilots would have not have been trained on this aircraft, to keep using the same 737 pilots, and thus save plenty of money when it came down to buying the aircraft. it would have been a simple swap and contunine for the airlines. So why was the 7m7 never built? well you see, back in 2011 boeing seemed to be on the verge of annoucing a new design for the middle of the market. rumors even had it, that it would be eleptical like the 7m7. boeing has designed patents wider than they are tall, so it was what the industry was expecting. flash foward to 2017, and boeing unveiled in which the design work would happen, by late 2018-2020, for a rumored 797. Which could have very well been the 7m7 of 2015. boeing have said it would be an hybrid on a wide and narrow body, like the 787 and 737 combined. Important dates have been apart of aircraft compenets since 2020, 2 years later boeing seemed to stagger at any mention of the 7m7, at the 2020 paris air show, airbus released its a321xlr securing orders left and right, and boeing was left holding the bag. likley, they decided to pause their review of their 797 design until they could factor in a competitive advantage of the a321xlr. the 797( the 7m7 design replacement) was put on back burner.

Attachments

-

Screenshot 2022-03-03 1.26.14 PM.png189.8 KB · Views: 106

Screenshot 2022-03-03 1.26.14 PM.png189.8 KB · Views: 106 -

Screenshot 2022-03-03 12.53.56 PM.png195.5 KB · Views: 93

Screenshot 2022-03-03 12.53.56 PM.png195.5 KB · Views: 93 -

Screenshot 2022-03-03 12.53.29 PM.png69.2 KB · Views: 96

Screenshot 2022-03-03 12.53.29 PM.png69.2 KB · Views: 96 -

Screenshot 2022-03-03 12.53.12 PM.png105.7 KB · Views: 104

Screenshot 2022-03-03 12.53.12 PM.png105.7 KB · Views: 104 -

Screenshot 2022-03-03 12.58.08 PM.png80.4 KB · Views: 99

Screenshot 2022-03-03 12.58.08 PM.png80.4 KB · Views: 99 -

Screenshot 2022-03-03 1.06.04 PM.png57.8 KB · Views: 89

Screenshot 2022-03-03 1.06.04 PM.png57.8 KB · Views: 89 -

Screenshot 2022-03-03 1.07.14 PM.png75.3 KB · Views: 90

Screenshot 2022-03-03 1.07.14 PM.png75.3 KB · Views: 90 -

Screenshot 2022-03-03 1.09.47 PM.png130.3 KB · Views: 96

Screenshot 2022-03-03 1.09.47 PM.png130.3 KB · Views: 96 -

Screenshot 2022-03-03 1.11.02 PM.png57.8 KB · Views: 92

Screenshot 2022-03-03 1.11.02 PM.png57.8 KB · Views: 92 -

Screenshot 2022-03-03 1.15.29 PM.png226.3 KB · Views: 85

Screenshot 2022-03-03 1.15.29 PM.png226.3 KB · Views: 85 -

Screenshot 2022-03-03 1.26.00 PM.png151.5 KB · Views: 97

Screenshot 2022-03-03 1.26.00 PM.png151.5 KB · Views: 97 -

Screenshot 2022-03-03 1.26.07 PM.png82.5 KB · Views: 104

Screenshot 2022-03-03 1.26.07 PM.png82.5 KB · Views: 104

- Joined

- 16 April 2008

- Messages

- 9,544

- Reaction score

- 14,278

Existing thread here: https://www.secretprojects.co.uk/threads/boeing-middle-of-the-market”-mom-airliner.22402/

threads merged

threads merged

Last edited by a moderator:

- Joined

- 27 December 2005

- Messages

- 17,661

- Reaction score

- 25,687

Consider using paragraphs if you want people to be able to read large posts comfortably.

- Joined

- 25 July 2007

- Messages

- 4,283

- Reaction score

- 4,126

Is this based on anything beyond speculation?

The 'Middle of the Market' stuff came from a July 2016 airline survey report produced by Bank of America Merill Lynch Global Research and the Research Division of Penton Aviation Week Network. The results of this study were released at Farnborough but, initially at least, it wasn't aimed specifically at Boeing.

- Joined

- 5 May 2007

- Messages

- 350

- Reaction score

- 400

Wow. . . The NMA saga continues. . .

Simply Flying - Boeing Shelves Plans For Any New Midsized Airplane Until 2035

Don’t expect to see a “Boeing 797” within the next decade.

by Jonathan E. Hendry - November 4, 2022

Simply Flying - Boeing Shelves Plans For Any New Midsized Airplane Until 2035

Don’t expect to see a “Boeing 797” within the next decade.

by Jonathan E. Hendry - November 4, 2022

Boeing Chief Executive Officer David Calhoun confirmed to investors this week that the aircraft manufacturer is not looking to introduce a brand-new model anytime soon. He cited the lack of propulsion systems on the horizon that can deliver the improvements to make developing a new airframe worthwhile.

As aircraft often remain in the market for many years, Calhoun wants the next jet to be groundbreaking rather than rushed through to fill a gap. He explained that fuel efficiency and carbon emissions reductions are crucial hurdles that Boeing must overcome before moving forward.

Boeing estimates that customers will want 20-30% cost savings over existing models before considering a fleet renewal. Aircraft manufacturers can achieve this partially by integrating new technology, but a significant portion will likely come from reduced fuel consumption. CEO of Boeing, Dave Calhoun, cited the lack of propulsion technology available that would deliver the desired efficiency:

“If it doesn’t have a sustainability wrapper all around it, if it can’t meet the emissions tests, if it can’t deliver significant performance advantages, then there won’t be an airplane.”

He went on to conclude:

"There'll be a moment in time where we'll pull the rabbit out of the hat and introduce a new airplane sometime in the middle of the next decade."

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

Talk about skulls filled with concrete...

- Joined

- 4 July 2010

- Messages

- 2,502

- Reaction score

- 3,051

And, conveniently for Mr Calhoun, he'll be on a golf course enjoying his stupendously large retirement holdings by then."There'll be a moment in time where we'll pull the rabbit out of the hat and introduce a new airplane sometime in the middle of the next decade."

- Joined

- 5 May 2007

- Messages

- 350

- Reaction score

- 400

A variation on the theme. Linked at the title is the podcast as well as the transcript (for those who'd rather read the discussion than listen to it.) I've included an excerpt below, because I have no doubt that many here have expressed and or thought to themselves similarly, but the whole discussion is worth a listen/read.

Aviation Week & Space Technology Podcast: Boeing’s Latest NMA Plan - No More Aircraft

November 10, 2022

by Joe Anselmo, Michael Bruno, Jens Flottau, & Guy Norris

Excerpt:

Aviation Week & Space Technology Podcast: Boeing’s Latest NMA Plan - No More Aircraft

November 10, 2022

by Joe Anselmo, Michael Bruno, Jens Flottau, & Guy Norris

Excerpt:

Guy Norris:

Michael, this is just to add to something that Joe observed early on in the beginning of this podcast. I remember as a young, foolish, naive journalist covering McDonnell Douglas in the '90s, I was amazed when the Wall Street Journal gave McDonnell Douglas full marks for not launching the MD-12. Their share price rocketed up and everybody seemed delighted and I was thinking, “What's going on? It's the beginning of the end,” or the end had already been coming for a long time before that, the last all-new airplane having been launched in the '60s with the DC-10 really.

But I didn't understand it, and of course you're absolutely right. It's all about Wall Street. And that was the moment where I realized that this game wasn't just about new air planes. It's a much bigger picture than that. Of course what they were doing is they were fattening the turkey for the Christmas sale where Boeing came in and the merger was completed. But anyway, that was a very good observation.

Joe Anselmo:

Guy, you preempted me. That was actually going to be my next question to you, because you and I have been around long enough to remember McDonnell Douglas and I think our younger listeners might be surprised to hear that McDonnell Douglas had a huge lead on Airbus. Airbus was a distant third in this market, and then McDonnell Douglas seemed to focus on shareholders and stopped investing in the future. By 1997 it was gone. Just gone.

Guy Norris:

Absolutely. And I think that's one of the things that are Richard Aboulafia, who's a friend of the podcast, has observed quite rightly, that if you look at the trajectory in history, that's exactly what happened. McDonnell Douglas really stopped investing in all new designs and it withered on the vine. Airbus came in, an aggressive competitor, and it was able to bite away mostly at McDonnell Douglas's market share before of course it became a duopoly.

Last edited:

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

Just in case anyone is looking for it, the old 'Udvar-Hazy reveals preferences for Boeing's next project' thread was merged into this one.

There is a possibility that Boeing is just waiting for Airbus to be fully committed with the massive investment of a full rate production of their XLR321 before announcing a new design. Strategically, that would be the inflexion point to gain the most momentum before Airbus would be able to catch up.

But then, the Mc Donnell syndrome is loudly buzzing my ears too.

But then, the Mc Donnell syndrome is loudly buzzing my ears too.

- Joined

- 6 September 2006

- Messages

- 4,808

- Reaction score

- 9,315

I'm not sure the MD-12 is all that instructive. Arguably it would have been as great a flop as the A380 and $4 billion R&D costs was not to be sniffed at. And at the time the MD-11 was hardly selling like hot cakes with high sales costs to cover the $1.7 billion development costs and with hindsight the tri-jet was the wrong move as ETOPS came about and aircraft like the 777 were the future.

Yes sticking with the DC-9 and DC-10 design philosophy was probably backwards thinking but I get the sense economic downturns in the 80s and early 90s conspired to restrict what McD could afford to do and there just wasn't the funding or impetus to do a clean-sheet design.

Boeing has more cushion to do something new but let's not kid ourselves that a 7x7 would be drastically different to the current spamtube with two turbofans. 30% fuel reduction sounds a big ask.

Yes sticking with the DC-9 and DC-10 design philosophy was probably backwards thinking but I get the sense economic downturns in the 80s and early 90s conspired to restrict what McD could afford to do and there just wasn't the funding or impetus to do a clean-sheet design.

Boeing has more cushion to do something new but let's not kid ourselves that a 7x7 would be drastically different to the current spamtube with two turbofans. 30% fuel reduction sounds a big ask.

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

- Joined

- 9 October 2009

- Messages

- 21,818

- Reaction score

- 13,344

taildragger

You can count on me - I won a contest

- Joined

- 2 November 2008

- Messages

- 403

- Reaction score

- 497

The availability of 777-class engines was easily forseeable when the MD-11 was launched. I suspect that McDonnell Douglas saw a window before their arrival when a modern trijet would be the best DC-10/L1011/early 747 replacement. It would allow them to remain viable with a redesigned airplane that the competition would have to design from scratch. McD did envision a twin-engined development that looks a lot like a 777/A330 (see MD-20).I'm not sure the MD-12 is all that instructive. Arguably it would have been as great a flop as the A380 and $4 billion R&D costs was not to be sniffed at. And at the time the MD-11 was hardly selling like hot cakes with high sales costs to cover the $1.7 billion development costs and with hindsight the tri-jet was the wrong move as ETOPS came about and aircraft like the 777 were the future.

Yes sticking with the DC-9 and DC-10 design philosophy was probably backwards thinking but I get the sense economic downturns in the 80s and early 90s conspired to restrict what McD could afford to do and there just wasn't the funding or impetus to do a clean-sheet design.

Boeing has more cushion to do something new but let's not kid ourselves that a 7x7 would be drastically different to the current spamtube with two turbofans. 30% fuel reduction sounds a big ask.

Unfortunately, the aircraft had a rough entry into service and the time spent reducing drag to meet performance guarantees cut into the window of opportunity, it otherwise might have kept McD in the game.

Last edited:

- Joined

- 28 January 2008

- Messages

- 979

- Reaction score

- 2,072

It's too bad the Sonic Cruiser did not go anywhere, it was a nice design but did not fit the airline model and was designed for high altitude and flying in the transonic region. Apparently from info I got from some former Boeing counterparts, it seemed the SC had an efficient inlet/propulsion system, this is why Boeing did not really discuss propulsion. The 777X is having manufacturing issues and along with the 737 Max and KC-46 debacles, Boeing sure has lost their way and it's very unfortunate. I wonder if there really is a market for a new 757/767 class-type airliner?

Helix88

ACCESS: Restricted

- Joined

- 6 May 2021

- Messages

- 29

- Reaction score

- 44

Calhoun has stated that the next new aircraft will likely not materialize until 2030 or beyond. When it does, it has a good chance of using the truss braced wing concept that Boeing is collaborating with NASA on currently.

- Joined

- 1 April 2006

- Messages

- 11,336

- Reaction score

- 9,977

Boeing To Focus On Truss-Braced Wing, Autonomy For Next Aircraft, Calhoun Says | Aviation Week Network

Boeing’s commercial aircraft development efforts are focused on emerging airframe technologies that could lead to a new aircraft available starting in 2035.

Kiltonge

Greetings Earthling

- Joined

- 24 January 2013

- Messages

- 613

- Reaction score

- 1,108

Boeing To Focus On Truss-Braced Wing, Autonomy For Next Aircraft, Calhoun Says | Aviation Week Network

Boeing’s commercial aircraft development efforts are focused on emerging airframe technologies that could lead to a new aircraft available starting in 2035.aviationweek.com

Maurice Hurel would probably be amused to hear that high-aspect truss-braced wings are "transformative" in 2023. As would Shorts.

ADVANCEDBOY

ACCESS: Secret

- Joined

- 3 February 2011

- Messages

- 335

- Reaction score

- 88

Every decade they want to create an illusion as if they are going to build something exciting. And in my deleted comment I clearly stated that NMA won`t be built long before it was announced dead. And the same fate will be met by that truss design. The idea is to pump the stock price up, and then slowly watch it deflate back to reality when people realize Boeing is bluffing umptieth time. If they can`t build a new truck cabin or train, or bus, what makes you believe they can build a next gen airliner? There is a large difference between government paid and ordered F-22 and a civilian aircraft that has to pull through on its own merit in international waters.

All I see is Airbus making a commitment for the next gen airliner in whatever segment they decide it`s crucial, while Boeing will most likely resort to lipstick on a pig strategy. Squeezing blood out of a stone. The same pattern could be observed in all US precision manufacturing sectors. Why would this be different? It is either lipstick or rebadging. Let`s make an educated guess , by what year Airbus will be making 2x more aircraft than Boeing. By 2029? 2032? How I wish I was wrong and Boeing would wake up from its own induced coma of incompetence.

All I see is Airbus making a commitment for the next gen airliner in whatever segment they decide it`s crucial, while Boeing will most likely resort to lipstick on a pig strategy. Squeezing blood out of a stone. The same pattern could be observed in all US precision manufacturing sectors. Why would this be different? It is either lipstick or rebadging. Let`s make an educated guess , by what year Airbus will be making 2x more aircraft than Boeing. By 2029? 2032? How I wish I was wrong and Boeing would wake up from its own induced coma of incompetence.

Airbus has zero incentive to build an NMA...

Even Gov subsidies won't probably push them for long to really make the commitment as, so far, accountability has been missing in those programs (EU launched).

On the contrary, if it's not Boeing, it will be another company. Let's not forget that China is entering the market with a push on Airbus reserved domain. What would be then the most clever thing to do for Boeing? Let them do what they are doing and cut future RoI by stealing the high end segment of that market: ViP and corporate seating. How? Well, as already discussed elsewhere, building a Supersonic for 50+ pax. (the average max seating capacity of first class long range aircragt).

What's then left profitable on this market segment? Hyper efficient airplane, amortized on a very long term coming after the battle b/w Airbus and China has raged, drawing ressources away to compete on innovation, on a timely manner.

As you can see, it is very possible that Boeing corporate managers are spot on in their analysis...

Obviously, this is all dynamic and the game is not set.

Even Gov subsidies won't probably push them for long to really make the commitment as, so far, accountability has been missing in those programs (EU launched).

On the contrary, if it's not Boeing, it will be another company. Let's not forget that China is entering the market with a push on Airbus reserved domain. What would be then the most clever thing to do for Boeing? Let them do what they are doing and cut future RoI by stealing the high end segment of that market: ViP and corporate seating. How? Well, as already discussed elsewhere, building a Supersonic for 50+ pax. (the average max seating capacity of first class long range aircragt).

What's then left profitable on this market segment? Hyper efficient airplane, amortized on a very long term coming after the battle b/w Airbus and China has raged, drawing ressources away to compete on innovation, on a timely manner.

As you can see, it is very possible that Boeing corporate managers are spot on in their analysis...

Obviously, this is all dynamic and the game is not set.

Last edited:

kaiserd

I really should change my personal text

- Joined

- 25 October 2013

- Messages

- 1,665

- Reaction score

- 1,718

Boeing seem a bit trapped by their own strategic errors and by a series of related incentives that currently reward/ push them towards planning based in the shorter to medium term rather than for the medium to longer term.

It’s not some clever strategy with a secret magic rabbit to be pulled from a hat (a Boeing 50 seat supersonic jet probably doesn’t even exist in project outline terms, let alone as Boeing’s secret Black Adder-esque “cunning plan” to reshape the industry and come out back on top).

However that doesn’t mean that every potentially high risk/ high reward “Hail Mary” move is a good idea either; for Boeing the MOM/ MNA potential moment for success probably passed years ago.

It’s not some clever strategy with a secret magic rabbit to be pulled from a hat (a Boeing 50 seat supersonic jet probably doesn’t even exist in project outline terms, let alone as Boeing’s secret Black Adder-esque “cunning plan” to reshape the industry and come out back on top).

However that doesn’t mean that every potentially high risk/ high reward “Hail Mary” move is a good idea either; for Boeing the MOM/ MNA potential moment for success probably passed years ago.

- Joined

- 25 June 2009

- Messages

- 14,664

- Reaction score

- 5,833

Source: Australian Aviation, April 2018.Making a sausage

Boeing’s plans for a tasty ‘new mid-market airplane’

WRITER: JORDAN CHONG

(extract)

How the NMA might look was revealed in a blog post by respected aviation writer Jon Ostrower in early March. An image published on Ostrower’s blog shows a concept design that features a Boeing 767-style nose, 787-style wing and cabin windows and a 737 MAX-style tail cone. “Highly unlikely to be the final form of the eventual 797, its attributes hint strongly at some of Boeing’s efficiency enablers for its

next-generation of medium-range airliners,” Ostrower wrote.

“Elements adapted from existing aircraft are apparent across this early iteration of the NMA design: A 737 MAX-style tail cone, larger 787/777X-sized cabin windows, and a 757/767/777-style windscreen. The door arrangement matches that of Boeing’s last “small twin,” the

767-200, very strongly suggesting a twin-aisle design.”

Entry into service is projected to occur in the 2024 to 2025 timeframe. That puts the NMA somewhere between Boeing’s largest narrowbody

the 737 MAX 10, (3,215nm range with 230 passengers in a single-class layout), and its smallest widebody the 787-8 (7,355nm range with 242 passengers in a two-class configuration).

And Boeing’s initial estimates for the NMA suggest there might be a market for about 4,000 aircraft. Some aviation analysts, who might

define the market differently, have put forward a number closer to 2,500. The replacement of the 757 and 767s would no doubt be a key plank of the potential market for the aircraft. However, Tinseth said Boeing has higher ambitions for the proposed NMA than just replacing those older models.

Rather, the NMA is slated to offer airlines the potential to open up or make profitable thousands of routes that cannot be served with single aisle aircraft or were being operated inefficiently with widebody equipment.

“On the NMA you have an airplane that is kind of alone,” Tinseth said. “It’s an airplane that can disrupt and change and unlock the market so this is about changing airlines’ networks in ways that they can’t operate today.”

“It’s going to open up new markets we haven’t seen before like the 787. “That’s the interesting thing about the airplane. It is also the challenge.”

Tinseth said Boeing was in discussions with the three major engine manufacturers – understood to be CFM/GE, Pratt & Whitney and Rolls-Royce – on the proposed 50,000lb thrust engine, adding that the trio were the only suppliers it was currently working with.

Boeing has sought the views of about 50 airlines and leasing companies around the world on what the aircraft should be designed for.

Tinseth declined to go into details of how diverse the range of opinions were, saying only that “those sides were coming together”.

“It’s a little bit like making sausage. It is not a process you want to see but at the end of the day the sausage tastes good,” Tinseth said. “So you have to really figure out how you blend all of these requirements together.

“We have a very strong idea what it will have to do, how the airplane will have to come together, what kind of configuration, what kind of technologies.”

- Joined

- 5 May 2007

- Messages

- 350

- Reaction score

- 400

Never has the term "saga" been used more appropriately in a thread title. Almost a decade after this thread was started, the saga continues. . . .

See excerpt below, the complete column is linked at the title. It can also be found at the Internet Wayback Machine archive (link).

Forbes Magazine: Why A B797 Revival Should Be Boeing’s New $50 Billion Plane

by Marisa Garcia - Senior Contributor

April 15, 2024

See excerpt below, the complete column is linked at the title. It can also be found at the Internet Wayback Machine archive (link).

Forbes Magazine: Why A B797 Revival Should Be Boeing’s New $50 Billion Plane

by Marisa Garcia - Senior Contributor

April 15, 2024

With Boeing facing a Senate Subcommittee hearing into whistleblower allegations on its widebody 787 Dreamliner and 777 programs, this might seem like an odd time to review the manufacturer’s plans for its next aircraft.

However, given the long timeline for developing a new aircraft and airline’s urgent need for more capacity, the decision must come soon.

Boeing CEO Dave Calhoun has said this is one of the issues his successor must address, and set a price tag of $50 billion dollars for the program.

Some might bristle at the price tag, but industry watchers believe it could be money well spent.

. . .

Industry Analyst Addison Schonland of the AirInsight Group, told me there is a sound basis for Boeing to develop a 797 middle-of-market plane now, no matter what else is happening or what they ultimately decide to call it.

“I think the answer is the A321 backlog,” Schonland said. “Its huge and keeps growing. Also, the MAX 10, even a poor competitor to the A321, is the second best-selling MAX.”

. . .

While Boeing’s top priority must be to regain the confidence of airlines, regulators and the flying public, the manufacturer must find an engineering slot for this aircraft soon.

As Aviation Week’s Executive Editor, Commercial Aviation, Jens Flottau, said in a podcast following the Boeing leadership shake-up, “They can barely afford it now, they can also barely afford not to do this. One element that we also need to talk about is engineering skills. If you wait too long, a lot of the engineers will retire, will go away. You will lose the ability to develop new aircraft if you don't do that soon enough.”

Scott Kenny

ACCESS: USAP

- Joined

- 15 May 2023

- Messages

- 11,063

- Reaction score

- 13,280

I'm going to be a little perverse: "787SP,' like the sawed-off 747SP.

787 diameter fuselage and 3-3-3 seating in economy class, 2-2-2 in Business class. Roughly the length of a 767-200.

We can argue over whether it's low wing like all existing Boeings or a Truss-braced wing later.

787 diameter fuselage and 3-3-3 seating in economy class, 2-2-2 in Business class. Roughly the length of a 767-200.

We can argue over whether it's low wing like all existing Boeings or a Truss-braced wing later.

- Joined

- 4 July 2010

- Messages

- 2,502

- Reaction score

- 3,051

It should by no means be a $50B plane. 787 didn't cost anywhere near that much to develop and it's had an absolutely brutal development with all kinds of overruns. 777, the last Boeing airliner program run by someone who knew what they were doing, cost less than $10B in 2024 dollars. And they passed over Mulally for CEO in the 2000s because the board thought he spent too much on 777's development! There may be no clearer indication of how unsuited Calhoun and the current board are to leading that company than their complete ignorance of how it actually operates.Never has the term "saga" been used more appropriately in a thread title. Almost a decade after this thread was started, the saga continues. . . .

See excerpt below, the complete column is linked at the title. It can also be found at the Internet Wayback Machine archive (link).

Forbes Magazine: Why A B797 Revival Should Be Boeing’s New $50 Billion Plane

by Marisa Garcia - Senior Contributor

April 15, 2024

Similar threads

-

-

Photo of all of B707 through to B777 in a row

- Started by FutureSpaceTourist

- Replies: 7

-

-

-

Boeing clinches $2.4 billion helicopter deal with India

- Started by Triton

- Replies: 4