Project Hoefyster

Hoefyster was registered as a project in 1997. The awarding of a contract was announced by Public Enterprises minister Alec Erwin in his budget vote speech in the National Assembly on May 17, 2007. Not much seems to have happened in those first few years, arguably because the requirement was being defined and approved and because the funding was absent – much of the SA Army’s equipment budget were in those years diverted to the Strategic Defence Package acquisitions.

Early reports speculated that the MOWAG Piranha IV was a shoo-in for the deal, as OMC had then just been bought out by Vickers Defence Systems – a British concern – that had licensing rights to the Piranha IV. Counter-speculation at the time favoured the Piranha III, currently in use by the US Army as the Stryker armoured personnel carrier (APC).

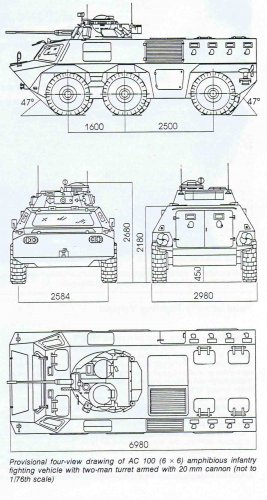

News of local developments came at African Aerospace and Defence 2002, when LMT proposed a family of 6x6 and 8x8 vehicles built to a common design. LMT MD Dr Stefan Nell told the author the 8x8 would be the basis of the new ICV while the 6x6 variant – identical in all respects bar the fourth axle – would serve as armoured personnel carrier for the motorised infantry. As such it could then replace the aging Casspir and Mamba APCs. Both designs, dubbed “Honeyguide” after a local bird, made maximum use of commercial-off-the-shelf technology. An electric drive proposal was also on the cards. Nell was adamant that the Army preferred a local solution rather than an import.

The “Honeyguide” 8x8 would have carried eight soldiers in the rear. Its crew consisted of a driver on the front right with a vehicle commander directly behind. In the Denel LIW 35/50mm turret, prescribed by the Army for the project at the time, sits the gunner and section leader/platoon commander. The vehicle concept offered 7,62mm NATO AP protection all round and was planned to absorb 30mm rounds at a 15 degree angle at a range of 1500m. The vehicle would have been 14,5mm proof from the front. Talk at the show was that a decision on a preferred “Hoefyster” design to be further engineered and developed would be made in January 2003.

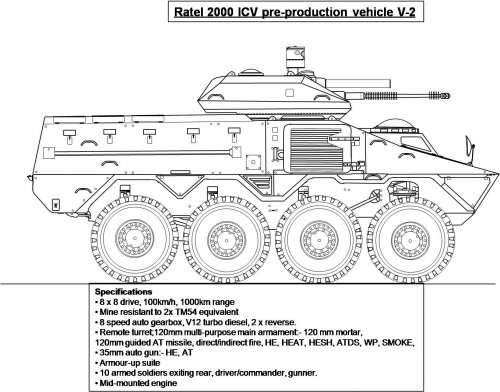

It is not clear such a decision was made. It appears that at least four domestic companies, including LMT, OMC and MDB were given seed money to develop prototypes. In early 2004 it was reported that the LMT design had victored. All were 8x8 designs designed to carry the Denel LCT35 turret. Scarcely had the news filtered out when the Army through its agent Armscor re-opened the competition and called on local and international companies to tender for the deal.

The Request for Proposals (RfP) was issued under the reference number MFT/2003/564 and asked eight South African companies and four international defence contractors to put forward ideas and quotes by February 25, 2005. Domestic companies asked to tender were state arms manufacturer Denel as well as private companies LMT, Benoni-based OMC, IST Dynamics, Industrial and Automotive Design SA, MDB, Advanced Technologies Engineering of Midrand, Grintron and Intertechnic. The four overseas contractors approached were GIAT Industries of France, Mowag Motorwagenfabrik AG of Switzerland and the pan-European Aeronautic, Defence and Space Company (EADS). The South African companies in particular were keen to bid and gladly showed off their ideas to selected journalists.

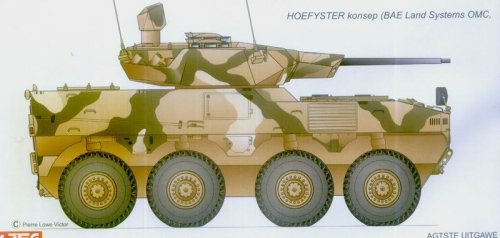

But, in February 2005, when the bids were due, only one was received, from a consortium involving Patria of Finland, Patria's part-owner, EADS, Denel, OMC and Land Mobility Technologies (LMT). The vehicle the group proposed was Patria's 8x8 Armoured Modular Vehicle (AMV), as redesigned for southern African conditions by LMT. The vehicle hulls were to be built by OMC and the turrets as well as guns would be provided by Denel.

So, what had happened? Questioned in 2005 about the paucity of bids, Department of Defence's (DoD) chief of acquisition and procurement, Bruce Ramfolo said the tender process followed on their behalf by Armscor was sound and "neither Armscor nor DoD are able to force any industry to participate." Ramfolo did not directly answer a question on why a foreign hull was preferred to a local design, saying instead that "no decision regarding the bid has been made and therefore no decision on the design has been made.”

Speaking around the same time, Strategic Defence Package critic, systems engineer and defence company MD Richard Young said the paucity of bids was disconcerting. It also appeared that potential competitors had been encouraged and "facilitated" to bid jointly. Asked whether there was something wrong with the DoD's tender process, Young said: "Yes, it's not constitutional." He explained that the White Paper on the South African Defence Related Industries of December 1999 said the constitution, in section 217, required that when organs of state contracted for goods or services, they must do so in accordance with national or provincial legislation that establishes a system which is fair, equitable, transparent, competitive and cost-effective. "At present defence acquisition is based more on balderdash, enrichment and expediency."

With the preference for a foreign product comes some spurious benefit. The project will be subject to countertrade as its value exceeds US10 million, the trigger-level for offsets or industrial participation. Part of the offset will be local licence manufacture of the vehicle – a questionable benefit considering South Africa’s pre-existing expertise in this field. The AMV is not a generational leap in technology as is the Hawk LIFT or the Saab Gripen advanced light fighter.

Hence, why the preference for an import over a range of local designs? The AMV acquisition may, in itself, be part of an offset for the Finnish Navy's acquisition of Denel's Umkhonto surface-to-air missile system. Finland in October 2002 signed a deal to buy the missiles, their launchers and associated fire-control equipment for six vessels. Then there was the ongoing financial woes of Denel to consider and attempts by the Department of Public Enterprises to tie up Denel with foreign partners to stem the financial bloodletting and secure export markets for Denel, something they were hopeless at when left to their own devices. And so speculation once again enters the picture. By July 2004 some were saying the deal would be a “wedding gift” in a Denel-EADS tie-up. At the time EADS was known to be keen in taking a stake in certain parts of the state concern. The enthusiasm is said to have faded when EADS did due diligence checks.

In May 2007, when Erwin announced the contract, talk was that the deal would see OMC, then owned by BAE Systems, and Denel Land Systems merge. CCII’s Young took a dim view of this, saying in a May 2007 e-mail this amounted to giving R4bn of the R8bn the deal was worth to the British for their “investment.”

Erwin’s announcement caused some surprise in light of comments by SA Army chief LTG Solly Shoke at various media briefings and observations by Armscor in Parliament in the early part of 2007. Speaking at a media briefing after a SA Army exercise at De Brug in November 2005, Shoke expressed some concerns over Hoefyster and said a review of the project as well as all other major SA Army projects were underway. A year later, at the same venue, he said that the project was at a “political level” and more enigmatically that it was going ahead but not in the way his audience imagined. At that time the AMV was already the only contender. Whether the present outcome represents a win or loss for Shoke remains to be seen. Shoke is known to have viewed favourably the further remanufacture of the Ratel.

In March 2007 Armscor briefed the National Assembly’s Portfolio Committee on Defence that negotiations were still underway and that the sticking point was cost: “The unit production cost and total project cost was not acceptable,” the arms agent said. “Project Hoefyster provides a complete Level 5 New Generation ICVPS (NGICVPS) to replace the Ratel infantry combat vehicle that has been in service since 1976. The offer as submitted on February 24, 2005 by Denel as main contractor, as well as a NGICVPS prototype vehicle was evaluated by Armscor and DAPD. The technical performance of the vehicle offered was mostly on par with the requirements, except for a few minor deviations that could be overcome with some minor design changes or adjustment in the specifications. The unit production cost and total project cost was not acceptable. The (Integrated Project Team) IPT was mandated to obtain the “best offer” from Denel, and present that for consideration to the Armaments Acquisition Steering Board in Project Study Report 3. Denel submitted a reviewed offer on November 18, 2005 to Armscor. The unit production price of the combat variants as well as the total project cost was still not acceptable. During December 2005 Armscor requested Denel to present their ‘best and final offer’ by February 2006. Denel submitted a revised offer (Issue C) on February 3, 2006. The prices offered for the turrets were considered acceptable, but the prices for the vehicle platforms were still unacceptable. Denel, together with Patria and OMC, again revised the offer and a more acceptable price was offered on March 3, 2006. The Project Control Board advised the IPT to enter into detail contract negotiations with Denel based on the revised offer received. The offer clarification process then started with Denel. Negotiations with Denel with the aim of arriving at a contracting position commenced on November 8, 2006.

Controversy

Hoefyster has become a controversial project for a host of reasons. These include (in no particular order):

• The small number ordered

• ICT

• The high cost per vehicle

• The choice of a foreign vice a local hull

• The choice of a new hull over a refurbishment of the Ratel

• Appointing Denel main contractor

• The length of the process

• The small number ordered: The Ratel is in use with the mechanised infantry, the armoured corps (as a tank destroyer and command vehicle) and the artillery (as a command and forward observation vehicle). At its height, the Ratel fleet mustered 1200 vehicles, and even with recent number reductions, the 264 AMVs will not replace the Ratel on a one-for-one basis. The number may allow for the re-equipping of the two regular mechanised infantry battalions, but unless more are bought, there will not be enough for the reserve regiments nor for the other corps and field headquarters that use the Ratel vehicle. This will mean the Ratel will continue in service and may need further upgrades. It also means the mechanised infantry will be stuck with two completely incompatible infantry combat vehicle product systems (ICVPS). Speaking to Engineering News , noted defence analyst Helmoed-Römer Heitman said about 600 vehicles are needed.

• ICT: The AMV will be fitted with state-of the-art information and communications technology (ICT). The command variant, Denel says “will be equipped with intricate network communications and battlefield awareness systems” that will allow for blue-force tracking and for vehicles to share data and exchange video” – pretty much standard internationally these days. However, this is not fitted to the rest of the Ratel fleet – and there are no published plans to do so, creating another field of incompatibility.

ICT companies involved in the acquisition expect to earn up to R270 million – or 3% of the contract value – for their command-and-control as well as communications contributions. However, industry sources said in May 2007 the ICT component of the project has been delayed for about six months. The cause of the delay is reportedly a poorly drafted tender specification for the command-and-control system that resulted in an inappropriate tender. The specification has since been rewritten and a new tender is in progress, the sources say. The tendered solution is expected to be compatible with Project Legend, the SA Army’s future C2 system.

• The high cost per vehicle: Basic arithmetic shows that at R8bn, the 264 vehicles will cost about R30.3 million each. This is pricey by any definition, particularly Young’s calculation of costs. An industry insider told the author it costs R30 million to tender a vehicle to the SANDF. The AMV was, according to this source, offered at R13 million each and costs R2 million to build . The source attributes the difference to development cost and risk. Denel apparently wants to write off the development cost against the first 50 vehicles. A 2003 news item suggests Poland paid zl.4.93 billion for up to 690 AMV in various configurations. The Army Guide reports the figure as US $1,560,000,000 or US $173,333,333 a year between 2004 and 2012. The site gives the Slovenian figure as US $361,000,000 (or US $60,166,667) for 135 vehicles between December 2006 and December 2011. Finland is said to have paid US126,000,000 for its 62 vehicles. By simple division the average unit cost for the Polish buy is about US $2.26 million; for the Slovenes is US $2.674 million and for the Finns is US $2.032 million. The Hoefyster price is double the above at US $4.32 million a piece (using a conversion factor of one US dollar costing seven rand). How can this be justified? The US Stryker, a 8x8 armoured personnel carrier based on the MOWAG Piranha III and fitted with an advanced ICT system, costs US$1.6 million (about R11 million at US$1 = R7) for the section carrier variant and US$3.7 million (about R25 million at the same exchange rate for the fire support variant). Hoefyster is clearly expensive from any point-of-view.

• The choice of a foreign vice a local hull: It is important to realise The Finnish EADS-Patria AMV was not a “natural” winner. South Africa has domestically designed all its light armoured vehicles since the 1970s. In fact the last foreign light armoured vehicle acquisition was the Alvis Saracen in the 1950s. There is much truth in the saying that imitation is the sincerest form of flattery and South Africa’s expertise can today be seen in nearly all new generation troop carriers, including the Thales Australia Bushmaster, the BAE Systems RG33, the Force Protection Buffalo and Cougar, as well as others. South African designs such as the BAE Systems RG31 and RG32 as well as the Dorbyl Chubby are also in widespread use, including with the US Army – no mean feat considering institutional and Congressional opposition to anything foreign. A number of experienced contractors offered local designs, including at least OMC, LMT and Emerging World Technologies (then the Mechanology Design Bureau).

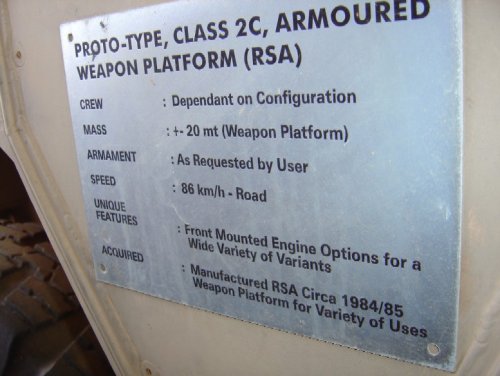

• The choice of a new hull over a refurbishment of the Ratel: There was nothing inevitable about purchasing a new hull. The Ratel is a well-manufactured armoured vehicle and has been remanufactured several times. Those familiar with armoured steel say it does not deteriorate with age and should have many more years of life. OMC and Emerging World Technologies (EWT, formerly Mechanology), proposed relatively inexpensive upgrades of the Ratel. Both companies had examples on display at African Aerospace and Defence 2006. EWT dubbed theirs the Ratel “Mk IV” and BAE Systems OMC called theirs the iKlwa, after Zulu King Shaka’s short spear. The basic change in both involved moving the infantry compartment aft by moving the engine compartment to the centre left of the vehicle, in the case of the Mk IV. The result is a spacious compartment that can take four stretchers and some walking wounded in the ambulance role. A standard infantry section fits in the roomy rear. The engine is so placed as not to interfere with the current turret. A passage to the turret and driver bypasses the engine on the right. The infantry debus from the rear – a much safer option than the current side doors, which are retained, the one on the right to access the turret and that on the left to access the engine. The conversion is available from US150,000 (about R1 million) per vehicle, EWT business development director MG Johan Jooste (Ret) told the author. This compares favourably with the about R30 million the Army will pay for each AMV. More ambitious upgrades, including a new engine pack, turret or primary weapon will cost more. An electric-drive variant is also available. The iKlwa costs slightly more.

• Appointing Denel main contractor: Traditionally, there has been a division of labour in the SA armaments industry. In the province of armoured vehicles, OMC has to date mostly been responsible for hull manufacture and final integration. As such, it was also prime contractor. Denel, by contrast, has little experience as main contractor in the armoured vehicle field. It is thus an open question what value the company can add, especially considering their less than stellar performance in another contract, GBADS. One source, who spoke to the author on condition of anonymity, questioned the choice of Denel as prime contractor for the project, citing its inability in delivering in another project, this time for a ground-based air defence solution (GBADS). Armscor reported to Parliament in March 2007 that by delivery in 2009 that multi-vendor, ICT-intensive project would be 54 months behind schedule . Denel itself admits that a “contract of this magnitude entails enormous project management skill and resources over many years,” the source says. As prime contractor Denel will be required to manage a supply chain of scores of local subcontractors, including SMME and BEE companies, all of which stand to have guaranteed business for the next 10 years, some with follow-on support work after delivery. Denel CE Shaun Liebenberg in May 2007 said South African companies “will deliver more than 70% of the total value of the contract,” 18% of which would be for the development of the turret systems.

The contract will see Denel deliver the troop carriers to the Army over a ten year period. "The awarding of this contract is a clear example of very high level alignment to meet South Africa's defence needs," says Liebenberg. But importantly, for Denel a new chapter has been written. This Armscor contract puts Denel Land Systems on the road to sustainability ." He continues: "Our Department of Public Enterprises and the Department of Defence, along with Armscor and the SANDF, all cooperated admirably to bring us to this point,” he said. "I foresee tremendous opportunities and further spin-offs to be realised through this contract, mainly for young technicians and engineering students who wish to make a career in the defence-related industry,” Liebenberg said as he waxed lyrical in a Denel press release. “This contract will contribute immensely to skills development and training, which are very much part of the Deputy President's Joint Initiative for Priority Skills Acquisition (JIPSA) programme.”

"Whilst recognising the huge challenge to execute a contract this big, I'm fully confident Denel Land Systems can manage it well," Liebenberg gushed. "This is the company that produced hundreds of the renowned South African G5 and G6 artillery systems, sold internationally, and that supplied the combat turret and weapons systems on the unmatched Rooikat armoured fighting vehicle."

The press release added that negotiations took three years and was “arguably the largest contract Denel has landed in its 16-year history.” It quoted Liebenberg as further saying: "We are exceedingly pleased to have been selected as prime contractor on this very important programme, more so as it indicates the SANDF and Armscor's confidence in the local defence industry's capabilities.” One can debate this: three years is a long time to haggle and the government could have better shown its trust in local industry by buying an entirely local product.

• The length of the process: Hoefyster was registered as a project in 1997. It has thus taken 10 years to bring to contract, which in anyone’s book is a long time. The delivery time, 10 years for some 260 vehicles is also rather sedentary.

Engineering News has noted that the Ratel has to date not gone a-peacekeeping, “and, although better armed and protected than the Casspir, and equipped with three axles, the modernisation programmes it has been subjected to have not increased its armour and it remains vulnerable to man-portable anti armour weapons such as the well-known RPG series.” Article writer Keith Campbell adds that such “vulnerabilities are serious because peacekeeping forces generally have to allow the other side to fire first and only then return fire.” This is true, but the AMV, as well as every other light ICV is equally vulnerable. Heitman adds: “RPG-proofing Ratels and Casspirs is a good idea and the US has shown how slat armour or chain-link fencing can be used inexpensively to do so; a more expensive solution is Saab Grintek’s LEDS system, which can reportedly destroy an RPG fired as close as 20m from the vehicle.” Heitman suggested to the Sunday Times that the vehicle might attract export orders “once it had been built and tested.”

Almost amusingly for a company that has sold modular turret solutions for a decade, the press release claims that “Denel engineers will have their work cut out to design [turrets for] the five variants.” Apparently “they are not off-the-shelf items . Whereas the future Command variant will be equipped with intricate network communications and battlefield awareness systems, the others carry a variety of weapons systems.”

“Several Denel businesses, along with numerous other specialist suppliers, will provide required systems for the turrets. Denel Dynamics' proven [ZT3] Ingwe long-range anti-armour missile is destined for the Missile variant. Whilst DLS has already started working on the weapons systems, including an indigenous 30mm cannon and a sophisticated mortar to be integrated in the turret, Denel Munitions will supply the ammunition and mortar bombs.” A report indicates that about 170 30mm turrets will be built.

Business Report newspaper in December 2005 published that Denel Land Systems had high hopes of manufacturing about 170 30mm cannon for the programme, after the US Bushmaster apparently did not fit all criteria. Analysts in the gun trade told the author there was little change of the company doing this economically. Defence Systems Daily reported in July 2004 that the AMV would be fitted with the new Denel LCT-30 turret sporting a 30mm cannon. A source told DSD this would likely be a Mauser made under license .

The opposition Democratic Alliance questioned the deal . Defence spokesman Andries Botha said he was taken by surprise by the announcement. "Certainly, we need these vehicles. The existing equipment is very outdated. But we discussed it in the portfolio committee a few days ago and there was no indication that it was this close to completion," he said. Botha said the DA favoured efforts to direct major projects towards South African industry "but not at the cost of efficiency or competitiveness". He said the committee had not been given enough information to know whether the Denel bid was the best option for the defence force.

To date, Finland has ordered 86 of the vehicles and Poland 690.

Suitability for the job

There is today a clear trend to 8x8 vehicles. The AMV is, on the face of it no better or worse than any other solution. However, the deal must be questioned on the basis of the small order placed, the long delivery time, the involvement of Denel as prime contractor and above all, the high cost of each individual vehicle. As an aside, one must also question the choice of a foreign over a local design, especially when it is recalled that at least eight South African concerns were adjudged competent to receive the RfP.