RAJEEV LALWANI: You touched on hypersonics. Obviously the buzzword in the industry. But that being said, can you talk about how you're performing versus your peers? I think the narrative out there is that you're sort of not winning your fair share. Is that fair or unfair?

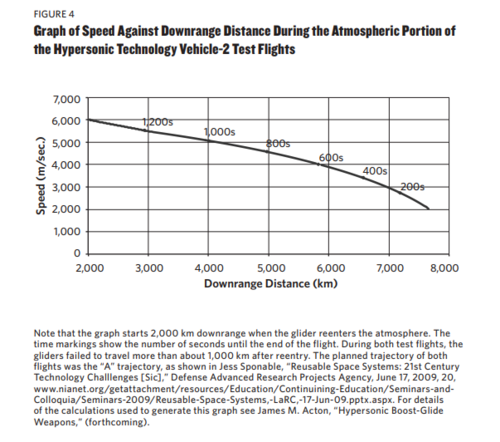

THOMAS A. KENNEDY: I think it's unfair. And let me first step back because you can't look at hypersonics without looking at counter-hypersonics. There's a whole new market. And this new market is the fact that things are going to be flying at Mach 5 or faster. And you have to -- and it can either be the things that you have or the things that the threat can have. But in any case, that marketplace is providing those type of systems that can fly faster than Mach 5. And then under that market, then you've got to counter those things that fly faster than Mach 5.

It turns out the harder problem is countering those things that fly higher than Mach 5. And it's actually a bigger market because not only do you have to have the effect that counters the weapon, but you also have to have the sensing capability and the command-and-control that can very quickly detect that target, that hypersonic target, track that hypersonic target and then hand it off in the right way to an effect that can be applied against it to take it out.

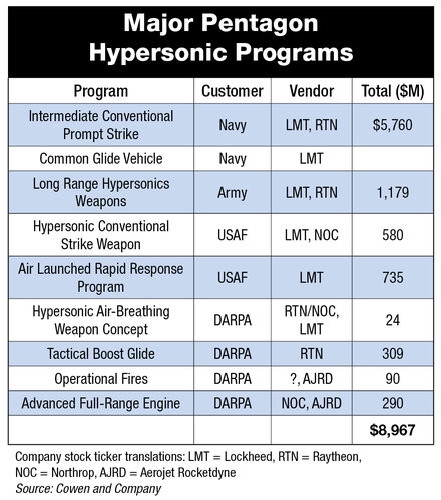

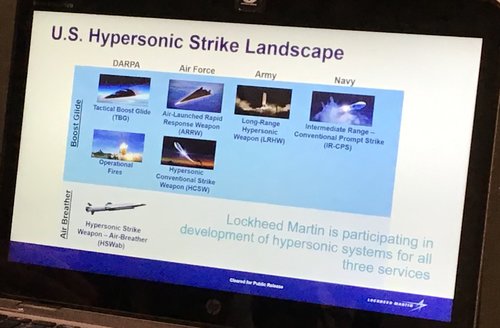

So we're in both of those markets. So let me start on the market on the hypersonics. So we are involved in the 2 key programs at DARPA and we're prime on those programs. One is called the HAWC program, which is a hypersonic air breathing weapon concept. The other one is a Tactical Boost Glide. And that's kind of the breakout of these 2 areas.

We're also involved in the Navy's conventional prompt strike under a subcontract to -- from Lockheed and then a recent contract came out to -- from the U.S. Army to a company called Dynetics to do a glide body work and we're under -- working on that element of that program. So -- and there are several classified air programs -- because I can't get into too much detail here but they're all in the hypersonic area.

We've actually had to build a whole building in Tucson, Arizona just because of the hypersonic work. So we are actively involved in hypersonics. It's a new area for us. It's an expansion area and so we're all in on that.

On the other side of it, I mentioned R stands for radar and also Raytheon, we are developing next generation sensors to be able to track these hypersonic weapons and so we're getting significant amount of funding for that technology. There's -- the -- because of these hypersonics and the speed of these hypersonic weapons, the U.S. government has an issue relative to being able to detect -- they can detect them, but being able to track them. So there's work that's going on to develop a potentially low earth orbit constellation of satellites, we're heavily engaged in the sensor technology for that.

And then in terms of the effects, we have the effects to go counter these hypersonic missiles, including missile-on-missile. We do the hit-to-kill stuff, we know how to do that. So we're actively involved in that. And we're also involved in other effects like High-Energy Lasers, HEL, and then also high-power microwaves. And if you want to know if we play in high-power microwaves, just remember, high-power microwaves is essentially your radar with a lot of power you put out over a very short time frame. So we are very heavily involved in that.

This whole area, when you combine the hypersonics and the counter-hypersonics, is a new market for us. And obviously for the DoD, it's emerging. It's not mature yet. The department really hasn't decided where they're going to go. So they're placing bets in many areas. We're making sure that the tables those bets are being placed on are Raytheon tables and I think we're doing better than the overall market and gaining access to that -- those funds.