alertken said:

Lockheed's share price rose when they announced programme phase-out. MDC merrily went into MD11...and expired. In retrospect...that ordering orgy, when Eastern/TWA launched L1011 and American/United launched DC-10, split the market and ensured both failed commercially. Nothing to do with Airbus - and I was unaware of any such assertion. A300-600R was sold to AA in 1985 after L1011 phase-out. PanAm/EA bought both types.

The MD11 has less to do with MD's merger with Boeing than the final failure of the MD-NG bid for the JSF. The former McDonnell defense arm generated the profits at MD, and St. Louis mismanaged and underfunded Long Beach, failing to generate a truly successful DC-9 successor before the entry of second generation 737 and the heavily subsidized A320. Single aisle airliners are the heart of the business, generating the volumes and cash flows for higher margin widebody projects. The slow death of MD's commercial division stems from the failure to shift away from the JT8D in a timely manner, then two desperately bad engine selections for the MD-90 and MD-95. The MD-12 wasn't launched because MD made a very honest and accurate estimations of the market and development costs, not overselling the type as Airbus did with the very similar A380.

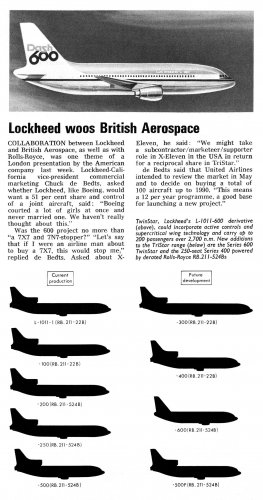

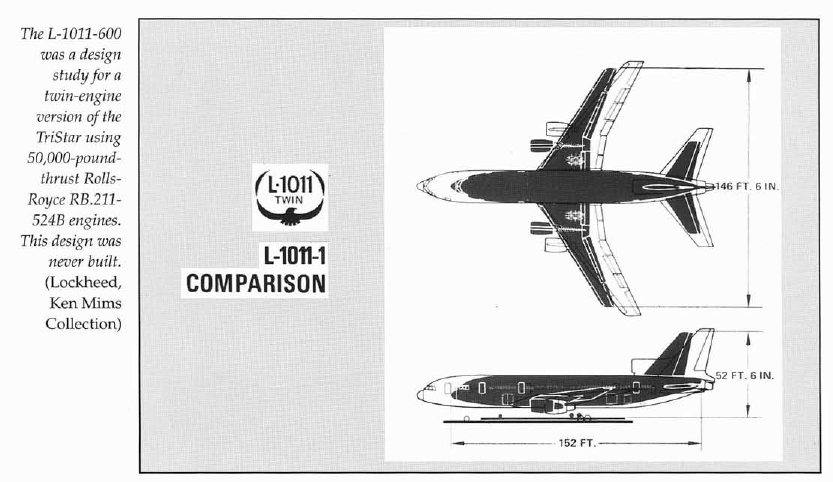

After the long hiatus between the unsuccessful Electra turboprop and the L-1011, Lockheed faced an uphill battle in re-entering the commercial market. In hindsight, Lockheed invested far too much in Burbank, overengineered the L-1011 itself and ultimately failed to appreciate the risks in single sourcing a technologically advanced turbofan from a troubled foreign supplier that was itself re-entering the mainstream of the commercial market. Rolls Royce killed the L-1011, but the project was sick from the very start.

Of course, the tale of the DC-10 and the L-1011 only underlines just how strong American anti-trust laws were during the 1970s. It is ironic that airlines were legally obliged to engage and price fixing and other forms of anti-consumer collusion by the regulations of the era, but the airlines were protected from similar anti-competitive practices by the airliner manufacturers. Considering the overall size of the market for widebody tri-jets, there was only room for a single competitor, but the formation of a monopoly, even in this emerging, relatively unimportant widebody tri-jet market segment would have been difficult, if not impossible due to anti-trust concerns. A monopolist, taxpayer subsidized commercial aviation sector remains unthinkable in the United States even today, although a monopolist, private sector approach has been tolerated since 1997.

The current WTO complaint apparently dates from no earlier than 2004, although it must be admitted that previous U.S. administrations were woefully slow to respond to patently unfair subsidies of Airbus. I honestly don't know if any statute of limitations applies to WTO claims, or precisely how it is claimed that unfair trade practices on the part of Airbus supposedly drove both Lockheed and McDonnell Douglas from the commercial airliner market.